The Jammu and Kashmir government has approved the imposition of property tax in all the Urban Local Bodies (ULBs) of the Union Territory. During the last couple of months, there were reports that the government was going to impose property tax in urban areas.

The Jammu and Kashmir Government on Tuesday issued an order imposing Property Tax on all properties – residential or non-residential at rates of 5% and 6% respectively annually of Taxable Annual Value (TAV) effective from Ist April 2023.

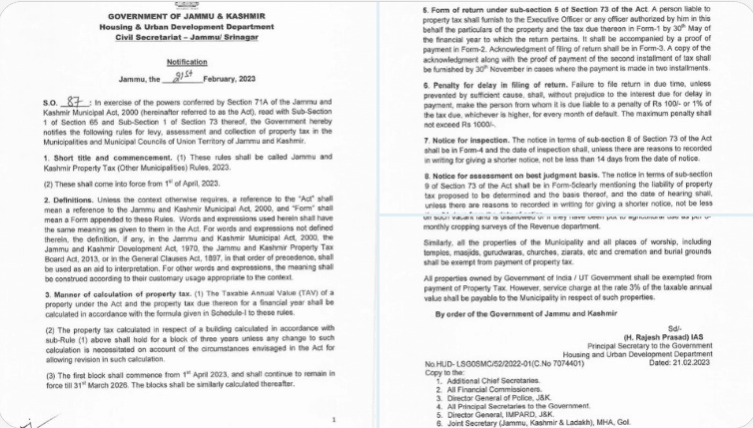

The notification issued as SO 87 exercising powers conferred by Section 71A of Jammu and Kashmir Municipal Act 2000 (read with sub-section 1 of section 65 and sub-section 1 of Section 73), the government notified new rules called Jammu and Kashmir Property Tax (Other Municipalities) Rules 2023 which shall come in force from April 01, 2023.

J&K was earlier exempted from property tax

Till now, Jammu and Kashmir was exempted from the property tax. The property tax has already been imposed in all states and Union Territories across the country. After the abrogation of Article 370 and the reorganization of the erstwhile state of Jammu and Kashmir, many central laws have been extended to the Union Territory.

The Housing and Urban Development Department on Tuesday notified the rules for levy, assessment, and collection of property tax in the Municipalities and Municipal Councils of Union Territory.

The calculation formula for the levy of Property Tax on Residential and Non-residential properties in Jammu Kashmir has been given in the Schedule–I attached to the notification. The Formula is based on the calculation of various factors called MTF (Municipality Type Factor), LVF ( Land Value Factor), FF ( Floor Factor), UTF ( Usage Type Factor), CTF (Construction Type Factor), AGF (Age Factor), SF ( Slab Factor) and Occupancy Status factors calculated together and then arrived at with the quotient given against each factor.

The annual Property Tax return is envisaged to be filed failing, which a penalty of one percent of the tax due or Rs 100 for every month of default with a maximum of up to Rs 1000.