In a major organizational rejig, the Jammu and Kashmir government on Friday, May 15, appointed Zubair Iqbal as the Managing Director of the J&K Bank. He had been serving as the Senior Vice President (SVP) of HDFC Bank.

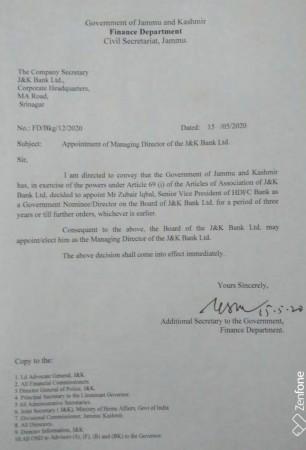

The order by the J&K government further notifies that Iqbal has been elected to the Board of Directors of the bank for a period of three years. "The Government of Jammu and Kashmir has decided to appoint Mr. Zubair Iqbal as a Government nominee/Director on the Board of J&K Bank Ltd. for three years. Consequently, the Board may appoint him as the Managing Director of the J&K Bank Ltd," read the order issued by the Finance Department of the Union Territory.

This will be Iqbal's second stint with the J&K Bank as he had been associated with it in the past as well. Back in 1989, he had joined the bank as a Probationary Officer (PO) and then continued to serve in different capacities before making a switch to the HDFC bank in 2006.

Reacting to the latest development, Iqbal told Kashmir Life, "It is actually returning to the home. There are issues and there are solutions. We will make it happen."

Structural revamp at J&K Bank

With the appointment of Iqbal as J&K Bank's first full-fledged Managing Director, the J&K government has bifurcated the position of Chairman and Managing Director (CMD). Both the Reserve of Bank India (RBI) and the Board of Directors of the J&K Bank had recommended that the government appoints separate Chairman and Managing Director.

So far, RK Chibber had been serving as the interim CMD of the J&K Bank. He was elected for the now ramified position in June last year following the removal of Parvez Ahmed by the then state government.

However, as per the latest order, Chibber will now be designated as the Chairman of the J&K Bank as he has been appointed to the bank's board as a non-executive director for the next three years.

Merger of J&K Bank, SBI off the table

The paramount organizational-level changes in the J&K Bank seem to have quashed all the possibilities of a merger with the State Bank Of India (SBI). One of the key reasons that propelled the authorities to consider joining hands with the public sector bank was "unsustainable structural issues" which cropped up in the J&K Bank lately.

But, with the division of the position of CMD, the gaps in the management are expected to subside. Notably, observers in Jammu and Kashmir were never in favor of the merger as the J&K Bank is considered one of the UT's strongest economic institutions.