Jammu and Kashmir Bank, which has an exposure of nearly Rs 250 crore in the Adani Group, on Friday said the bank investors have nothing to worry about as its loans to the embattled business group are secured.

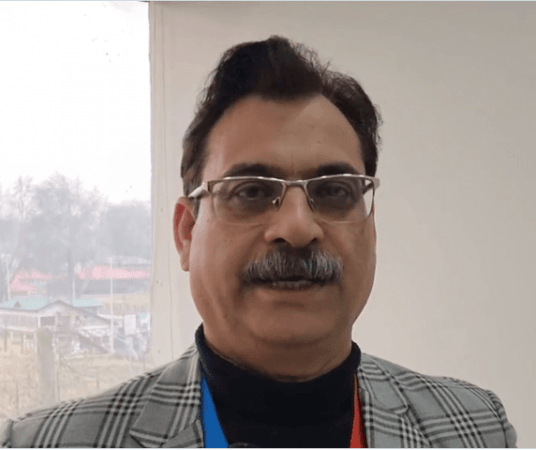

"Our loans to Adani Group are secured against the assets of the projects that were financed by Jammu and Kashmir Bank Limited," J&K Bank Deputy General Manager Nishikant Sharma told the media.

Sharma said J&K Bank had given a loan of Rs 400 crore to Adani Group to finance two thermal power projects – one in Maharashtra and one in Mudra, Gujarat.

"When we financed the two projects 10 years ago, our exposure was Rs 400 crore, which has now come from Rs 240 crore to Rs 250 crore. The payments are regular and both the power projects are operational with power purchase agreements in place. The bank has the first charge on their sale. Not a single penny is overdue from the Adani account," he informed.

J&K Bank management assures investors

Nishikant Sharma said that loans of J&K Bank Limited to Adani Group are secured against the assets of the projects that were financed by the Bank.

"The payments are regular and both the power projects are operational with power purchase agreements in place. The bank has the first charge on their sale. Not a single penny is overdue from the Adani account," he added.

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)