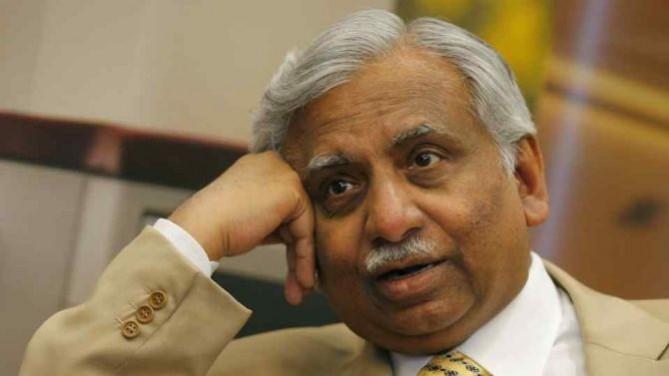

Even as the cash-strapped Jet Airways is staring at another loan repayment default, its lenders have asked founder Naresh Goyal and foreign partner Etihad Airways to bring in the funds they are expected to contribute under the provisional debt resolution plan, media reports say. However, another report says, a recent board meeting of United Arab Emirates (UAE)-based national carrier Etihad has could not take a decision on further investment in the Jet.

Jet Airways has to repay by March 28 up to $109 million to the HSBC Bank Middle East towards a $140-million loan taken in 2014. Abu Dhabi-headquartered United Arab Emirates (UAE) national carrier Etihad, which owns 24 per cent of its equity, is the guarantor for the loan. On March 11, Jet defaulted on repayment of $31 million against payable to HSBC, again guaranteed by Etihad.

Meanwhile, a report in the Mint citing unidentified sources said Etihad is unlikely to agree to the provisional debt resolution plan that the consortium of lenders proposed and the shareholders of Jet approved on February 14. A meeting of the board of Etihad in Abu Dhabi on Tuesday apparently remained inconclusive, with several members expressing reservations about the terms of the plan.

"We have made our stand clear. We (lenders) are supporting the arrangement (resolution). Let us see the response from other stakeholders. We will accordingly take a call," Dinabandhu Mohapatra, managing director and chief executive officer of Bank of India, one of the lenders to the ailing airline, told Business Standard. The report also quoted Sunil Mehta, chief of Punjab National Bank, as saying the lenders were going to decide jointly on further lending to the airline. He added that the decision would come with the participation of all stakeholders.

Industry sources estimate that Jet has a debt of over Rs 8,000 crore and needs to urgently meet repayment obligation of up to Rs 1,700 crore end of this month. The airline has defaulted already on external commercial borrowing repayments with many of its leased aircraft grounded for non-payment of lease instalments. From the airline's fleet of 119 aircraft, planes available for daily operation has dropped to more than half, leading to the cancellation of nearly 200 flights daily. The airline is also burdened with several months' salary payment backlog to its pilots and engineers along with other senior staff. The airline is also finding it difficult to retain qualified staff who are vulnerable to poaching by other airlines.

The Jet Airways board approved the provisional debt resolution plan on February 14, but founder chairman Naresh Goyal has been finding it difficult to get Etihad to approve it. Etihad wanted the lenders' consortium led by the State Bank of India (SBI) to get stock market regulator Securities and Exchange Board of India (Sebi) to waive the requirement of making a mandatory open offer if its equity participation exceeded a certain limit. The lenders could not guarantee such a waiver. The proposal envisages the conversion of the airline's debt to the banks into 114 million shares at a price of Rs 1 apiece based on Reserve Bank of India norms.