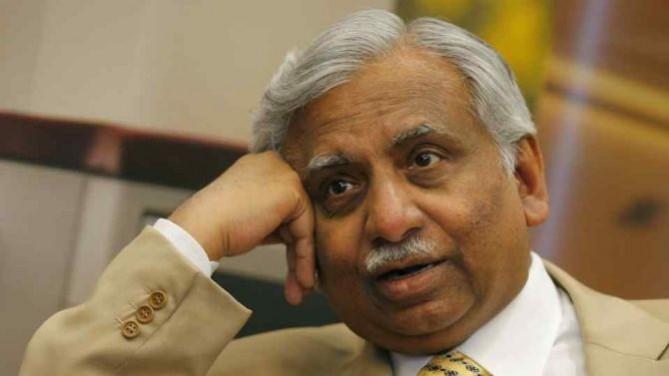

One of India's major private airline, Jet Airways' Chairman, Naresh Goyal has requested an urgent fund infusion of Rs 750 crore from its partner Etihad. Goyal highlighted "the very precarious" situation of the airline was pertaining to liquidity crunch. In recent times, low cash in hand has forced the airline to ground over 50 per cent of its fleet. Moreover, in his letter to the Gulf-based carrier's group chief executive Tony Douglas, Goyal said that the aviation ministry has also given its consent to pledge its shares in JetPrivelege for securing the interim funding. Currently, the airline holds 49.9 per cent share in JetPrivelege with Etihad holding the majority.

News agency, Press Trust of India has reported that in his letter, Goyal sought for an urgent fund infusion. "I now look forward to your support and cooperation in saving the airline by an urgent fund infusion of Rs 750 crore by early next week, so that a matching contribution from banks is also disbursed, as per the resolution plan," Goyal said.

It is to be noted that Jet Airways' rescue plan is scheduled to be discussed for approval today, March 11. Etihad board will be deciding on the proposed plan which will witness a major change in the promoters' shareholding. Last month, the Jet Airways' board approved a debt recast plan after which the lender would become the largest stakeholder in the airline. The airline also agreed to convert its equity into debt at a nominal price of Re 1. The plan was later approved by the shareholders on February 21.

![[Representational image] Jet Airways](https://data1.ibtimes.co.in/en/full/625755/jet-airways.jpg?h=450&l=70&t=41)

In his letter, he further said, "Any conditions precedent to the Rs 750 crore infusion by Etihad Airways may please be taken up with the banks and settled bilaterally with them so that the much-needed funding is made available to Jet Airways early next week." Goyal also said that the Airline has reached to a situation where an urgent fund is required and any further delay would severely affect its operation and could even result in its "grounding".

Jet has already grounded more than 50 per cent of its fleet and cancelled hundreds of flights across routes. The situation has become so critical that its lessors have threatened to take away planes if a consensus on the resolution is not reached by the end of March. The airline has defaulted on its repayment of the loans for several times in the past. Also, the salaries of its staff have been delayed for months now.