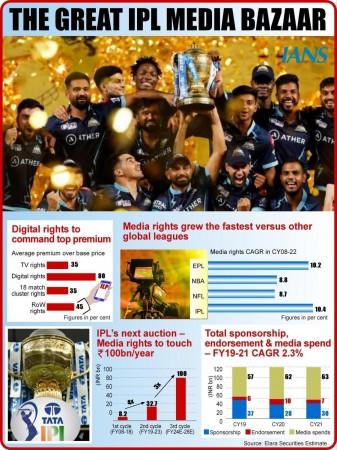

On pricing, IPL per match is poised at a 70 per cent discount to global averages, which may converge to 20-30 per cent, led by IPL renewal in 2023-2027. Also, IPL media rights revenue CAGR at 10.4 per cent is much higher than other global leagues' (EPL, NFL, NBA) 8 per cent CAGR since their inception, Elara Securities said in a report.

Thus, cricket, especially IPL, is approximating a trailblazer innings in India, Elara Securities said in a report.

The Global Sports industry has emerged as a mega-growth opportunity, with US sports' media rights revenue CAGR at 8.2 per cent through CY12-21, accounting 45.2 per cent of 2021 global media rights revenue.

Of this impressive pie, soccer commands a lion's share of 39 per cent.

However, of all the sports, cricket rules the Indian market, with a stupendous 94 per cent share in media rights vis-a-vis a mere 3 per cent, globally.

Cricket may continue to enjoy such sheer dominance in India, medium term, propped by large-lucrative properties such as IPL. Thus, expect IPL renewal to underpin media rights growth in India, medium term.

The report said digital segment, is the big delta for IPL. IPL teams' (average of four teams) revenue CAGR is 14 per cent historically.

Expect a 16 per cent CAGR through FY22-28E. Further, media rights revenue forms 70 per cent of total revenues and should sharply spike on rights renewal. Media rights in earlier cycle (2008-17) had grown 4x to Rs 163.47 billion (2018-22).

Expect IPL media rights for the next cycle (2023E-2028E) to grow in 3-4x range (25 per cent growth due to more matches) to Rs 500-600 billion, led by the sharpest growth in digital media, the report said.