After gaining for almost three years from falling crude oil prices globally, India saw its import bill rise for the financial year ended March 2017 (2016-17). The world's fastest-growing economy ended with an oil import bill of $69.72 billion (provisional) for 2016-17, up almost 9 percent from $63.97 billion in the preceding fiscal.

The rise in value terms marked an end to the gains the country had from the slump in crude oil imports caused by a supply glut that was addressed both by OPEC and non-OPEC members last November/December.

In its March 2017 report released on Monday, the Petroleum Planning and Analysis Cell (PPAC) said that the volume imports rose to 213 million metric tonnes (MMT) for 2016-17 from 202.85 MMT in 2015-16.

India benefitted a lot from falling crude oil prices globally, given that it meets 80 percent of its oil needs through imports. For 2013-14, the oil import bill was $167.6 billion when the average crude oil price for the Indian basket was $105.2 per barrel.

The next financial year saw the bill falling sharply to $112.7 billion at an average price of $85.2 per barrel, though the quantity imported remained almost steady at 189 MMT. For 2015-16, the bill plunged to a record low of $63.97 billion though the volume imported rose to 202.85 MMT.

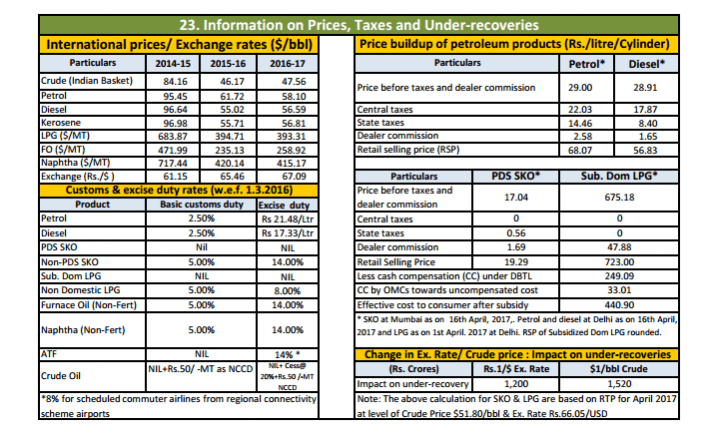

The price of Indian basket crude rose by 3 percent during 2016‐17 at an average of $47.56/bbl as against $46.18/bbl during 2015‐16, the PPAC said.

The Reserve Bank of India (RBI) said the fall had a positive impact on the country's overall imports.

"Imports contracted by 15.0 per cent to US$ 381.0 billion in 2015-16, primarily due to a sharp reduction in the oil import bill. With the price of imported crude oil declining by about 45 per cent during the year, petroleum, oil and lubricant (POL) imports fell by about 40 per cent even as volume picked up by 10.6 per cent over the previous year's level," the apex bank said in its annual report for 2015-16.

Cooking gas consumption on the rise

The push by the Narendra Modi government to cover more households, especially in rural areas, to switch to cooking gas from traditional sources such as firewood and kerosene, lifted consumption of LPG in 2016-17, according to the report.

"Total LPG consumption continuously for the last forty three months in a row recorded a positive growth of 1.9 percent during March 2017 and cumulative growth of 9.8 percent for the period April 2016 to March 2017," the PPAC report said.

The demand driven by Prime Minister Narendra Modi's scheme saw India becoming the second-largest importer of LPG in 2016-17, leaving Japan behind.

On Monday, IOC shares closed 0.64 percent lower at Rs 422 apiece, HPCL gained 0.51 percent to end at Rs 559, BPCL closed almost flat at Rs 715 and ONGC at Rs 182.

Other highlights of the PPAC report for March 2017:

Growth in ATF (aviation turbine fuel, or jet fuel) consumption was 12.1 percent for 2016-17, the highest annual growth rate since 2007‐08. The growth (in 2016-17) was mainly due to more than 20 percent growth in domestic passenger traffic during the year.

Cumulative gross production of natural gas was down 1.1 percent to 31,897 MMSCM for 2016‐17 in comparison to the preceding fiscal.

The price of Indian basket crude rose by 3 percent during 2016‐17 at an average of $47.56/bbl as against $46.18/bbl during 2015‐16.

There were 211 aviation fuel stations, of which 104 belong to Indian Oil Corporation (IOC) at the end of FY2017.

The number of retail fuel stations (petrol/diesel retail outlets) stood at 59,595 as of April 1, 2017, with almost 92 percent owned by state-owned companies, IOC, BPCL and HPCL. The rest belong to private companies that include Reliance Industries, Shell and Essar.