India has the world's sixth-biggest nominal GDP and third largest PPP. The benchmark Sensex increased 52% year on year.

The Forbes India Rich List—The 100 Richest Indians 2021 witnessed a 50% rise in wealth to $775 billion, up to $257 billion from 2020. 61 billionaires added $1 billion or more to their fortune this year, bringing the list's total to almost 80%.

Here are the top 10 richest people in India.

Mukesh Ambani

With a net worth of $97.7 billion as of 2021, Mukesh Ambani has been voted the country's richest man for the 14th consecutive year since 2008. He is the eighth richest man on earth and chairman of Reliance Industries, the first Indian business to exceed the US$200 market cap.

Reliance Industries has evolved from a textile and oil and energy firm to a vast conglomerate that encompasses retail stores, a mobile and internet provider, digital platforms, groceries, gadgets, and more. Additionally, Reliance owns Network18, a Forbes Media licensee.

With the launch of Jio 4G in 2016, Reliance ignited a pricing war in India's competitive telecom industry. During Covid-19, Ambani raised almost $20 billion by selling a third of Jio to investors including Facebook and Google.

Gautam Adani

With a net worth of $74.8 Billion, Gautam Adani is India's second-wealthiest individual and ranks 15th on the ranking of the world's wealthiest.

The Adani group is involved in a diverse variety of activities, from coal mining to gas and oil exploration to power production and port operations. It is one of the largest port operators in the country.

Gautam Adani dropped out of CN Vidyalaya's commerce department in Ahmedabad and entered family business in textiles family. Mumbai's booming diamond sector had always attracted him. He learned the business insider's techniques in three years and made his first million in three years as a diamond trader in Mumbai. Adani was 20 when he became a billionaire.

Adani has been the only Indian to establish five Rs.100,000 crore enterprises. He owns Gujarat's Mundra Port. Adani's foreign holdings include Australia's Abbott Point port and the world's biggest coal mine, Carmichael.

In September 2020, Adani bought a 74% interest in Mumbai's second-busiest airport. A combined venture with the wealthy Kuok clan's Wilmar International - Adani Wilmar, is also planned for IPO.

Shiv Nadar

With a net worth of $31.3 billion, Shiv Nadar is the founder and chairman of HCL Technology, India's leading technology firm. He has now resigned as Chairman of the HCL and transferred the role to his daughter.

While attending the Walchand Group's College of Engineering in Pune, Shiv Nadar began his profession. In August 1976, he resigned from his job and started HCL Enterprises in a garage. HCL began making calculators and microprocessors. In 1980, HCL entered the worldwide market by selling computers in Singapore.

HCL Technologies, with 169,000 employees across 50 countries, hires and trains high school graduates. Nadar has given $662 million to his Shiv Nadar Foundation, which supports education.

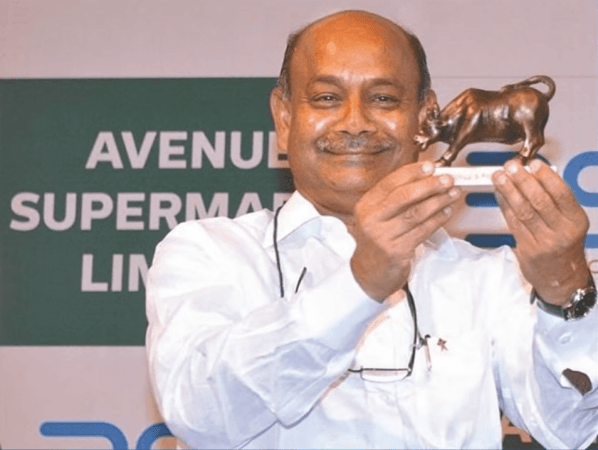

Radhakishan Damani

With a net worth of $29.4 billion, RK Damani began his journey as a stockbroker, he joined the retail business in 2002 with a single location in Mumbai. He left college while earning a B.Com degree at the University of Mumbai.

His rise is mostly due to the March 2017 IPO of Avenue Supermarts, which controls all D-mart shops in India. His brother, children, and wife are all committed to helping D-Mart develop in various ways. Today, he has 214 DMart branches throughout India.

Mr Damani has a modest lifestyle. Known as Mr White and White, he is so named because he usually wears a white shirt and white pants. He keeps a quiet profile and rarely gives interviews.

Radhakishan Damani initially found the stock market after his father's sudden death. Due to his timely investments and tactics, he is now one of the most recognised stock market figures. He holds stakes in VST Industries, India Cements, United Breweries and Blue Dart Express Ltd.

Cyrus Poonawalla

With a net worth of $19 billion, Cyrus Poonawalla's fortune rose the quickest among Indian billionaires and sixth fastest globally during the COVID-19 pandemic, owing to his firm, Serum Institute of India's, great business promise.

In 1966, he created the Serum Institute of India, which has grown to become the world's largest manufacturer of measles, influenza, and polio vaccinations. He planned to produce vaccinations using serum extracted from horses.

Poonawalla rose 57 positions to the 86th richest person in the world based on a 25% increase in his net worth over the pandemic's four months.

The serum just signed a deal with AstraZeneca to manufacture 1 billion doses of an Oxford University coronavirus vaccine. The company also helps UNICEF and PAHO. Exports account for 85% of business income. Serum claims it will be worth $100 billion by 2022.

Lakshmi Mittal

Living in the United Kingdom with a net worth of $18.8 billion, Lakshmi Mittal is the chairman of ArcelorMittal, the largest steel and mining enterprise in the world by production. He is renowned for transforming weak steel manufacturing firms into lucrative operations on a global scale.

Mittal attended St. Xavier's in Kolkata while working at his father's steel plant. Then in 1976, he established a steel factory in Indonesia. Mittal bought the state-owned.

He most recently acquired India's insolvent Essar Steel, which was formerly held by the Ruia family. He is also a member of the European Aeronautic Defense and Space Company's board of directors. Mittal was a 2008 recipient of the Forbes Lifetime Achievement Award.

The business recorded a $700 million financial loss in 2020, a year when steel shipments fell by nearly a fifth of steelworks in Tobago and Trinidad in 1989. He made them successful in a year. Mr Mittal handed over the CEO role to his son Aditya but remained as the company's executive chairman.

Savitri Jindal

With a net worth of $18 billion, Savitri Jindal's venture into business came following the loss of her husband. She is the owner of the Jindal Group, which operates in the steel, power, cement, and infrastructure sectors.

Savitri is not a self-made billionaire, but she has served as the chairman of India's largest steelmaker, the Jindal Group, for 14 years. Her Mumbai-based son Sajjan Jindal, who manages JSW Steel among other things, is in charge of the group's largest assets.

She also had a successful path as a politician and a social leader. Soon after going into the corporate sector, she got into politics by entering the Haryana government, reflecting the Indian National Congress party. Then in 2006, she was appointed Minister of State for Revenue. In 2013, she became the state cabinet's minister for urban local bodies.

Uday Kotak

With a net worth of 16.5 billion, Uday Kotak did not join his family's lucrative cotton trading company. Rather, he chose to start his own thing. In 1985, he founded a financial business, which he later converted into a bank. Now he is known as India's richest banker.

His Kotak Mahindra Bank has risen to become one of India's top four private sector banks, owing to its 2014 acquisition of ING Bank's Indian business.

Kotak Mahindra Finance Ltd. received its banking licence from the Reserve Bank of India on 22 March 2003, making it the first company in India's business history to do so.

Additionally, Kotak has a deep connection to cricket. He was an excellent cricketer who desired to pursue cricket as a profession as well. He was forced to quit owing to a head injury.

Anand Mahindra, chairman of the Mahindra Group, is the inspiration for the name Kotak Mahindra. He lent Uday Kotak Rs 1 lakh and promoted Kotak Mahindra Finance Ltd. But they share more than just a business relationship. The two are friends who admire one other's work.

Pallonji Mistry

With a net worth of $16.4 billion, Pallonji Mistry, a secretive tycoon, runs the 156-year-old Shapoorji Pallonji Group, based in Mumbai. He is one of India's most prosperous and influential industrialists, presiding over a construction empire spanning India, West Asia, and Africa.

The family's largest asset is an 18.4 per cent share in Tata Sons, the holding company for the Tata Group, a conglomerate of 30 firms worth $103 billion in sales. Pallonji's father was responsible for the construction of plants for Tata Motors and Tata Steel. Because the Tatas lacked the funds to pay for them, they instead handed him shares.

The Mistrys chose to sell their share in Tata Sons in September 2020, stating that "a division of interests will benefit all stakeholder groups."

Kumar Mangalam Birla

With a net worth of $15.8 billion, Kumar Mangalam Birla is the head of the Aditya Birla Group, which he inherited for the fourth generation in a row, he is responsible for cement and aluminium production, as well as retail, telecommunications, and financial services.

The Aditya Birla Group controls 30% of the world's largest aluminium rolling firm Hindalco and 32% of India's largest construction material maker Grasim Industries.

Birla became the heir apparent at 28 years to the family enterprise after his father Aditya Birla died in 1995. Within two days after the death, Kumar Birla established an objective, met with investors, and began his job.

His telecom company concept failed in 2016 when Jio entered the picture. Idea Cellular lost money for six quarters after Jio entered. To combat the market's fierce pricing war, the firm merged with Vodafone in August 2018. He holds 11% of Vodafone Idea, India's second-largest telecom business.