A technology hawk which bulks up India's foreign exchange pie could be slowing down, but a hawk is still a hawk even when it flies low. Indeed, growth rates have moderated for most IT services companies globally. Each company has a different painpoint (manufacturing, utilities, energy, healthcare and retail, among others), but at an aggregate level this has meant lower growth rate for India's tech services titans as well.

IT industry body Nasscom's constant currency guidance of 7-8 percent for 2017-18, is on the face of it, rather ominous. Nasscom has indicated that digital revenues will be between 15-20 percent of industry exports. That leaves a lot of room for growth in high-margin areas like artificial intelligence, machine learning and Web services which require fewer programmers and higher skillsets than the traditional package-based model.

The methodology of IT companies used to calculate their share of digital revenues has been called into question too often these days. But it is a fact that they have been seeing the need to invest more in digital services and artificial intelligence technologies which will need fewer programmers to manage the show -- and what clients, who are increasingly automating their processes, and need digital services in emerging niches like Web services and cloud computing are expecting from Indian tech vendors.

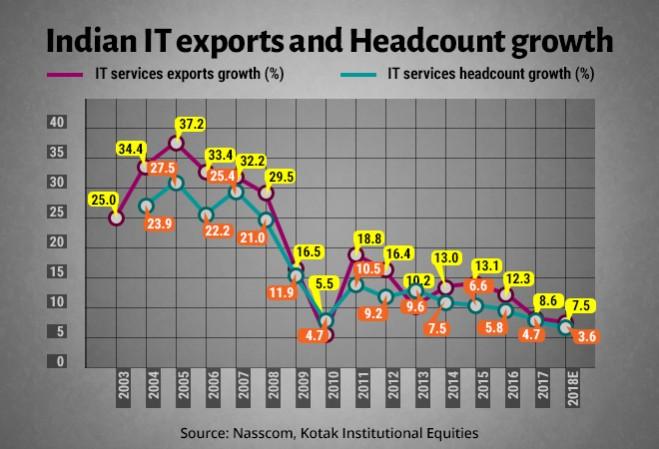

That said, the slow growth of Tier 1 IT companies in fiscal 2017, may not change in a hurry even though the industry has been adding $10-11 billion in revenues every year on a constant currency basis, -- while muting their headcounts (see chart) in proportion to falling revenues --, a trend which Nasscom expects to moderate in fiscal 2018.

A regrowth path

Growth is likely to remain modest till such time the contribution from digital revenues increases to a reasonable portion of overall revenues. Recovery in any case will be uneven, with companies which invested in digital services likely to be the only ones that will show revival in growth rates in future.

Nasscom's latest estimate for net employment in fiscal 2018, at approximately 4 percent, is lower than industry exports growth of 7-8 percent. While the industry will add net employment of 130,000-150,000 in 2018, it would be lower than exports growth of 7-8 percent, says research firm Kotak Institutional Equities. This indicates that the benefits of automation and increasing overseas acquisitions have resulted in higher revenue productivity and less need for a steadily increasing headcount.

There is also the increasing contribution from the digital realm where higher margins are being realised through automation and the higher productivity it brings with fewer people on the job. This muted headcount addition down the years, against the backdrop of the annual supply of engineers touching 1.5 million, will continue to keep entry level wages under pressure.

The bugbear of balancing margins against volumes was compounded by H1-B visa pressures from the Trump regime. Infosys CEO Vishal Sikka reiterated earlier this week that the Bangalore-based IT services innovator is under no compulsion to crave more of the contentious visas in the coming fiscal. But volumes, as much as margins, will remain under pressure over the next few quarters.

The IT growth headwinds to watch out for in 2018 are multifold -- a combination of slow pace of deal closures; continuing captive shift; fragmented share of new BPO contracts thanks to competition from countries like the Phillippines, Malaysia and Singapore; financial services spending still not being supercharged in an extended worldwide recession; and, market share gain by consulting firms like Accenture in the digital spending space.

Inward techspends

More than the slowdown, -- which has affected demand for innovative services with high-margin product-to-services mixes and slowing growth from traditional services --, Indian IT firms could be facing indirect challenges from the inward technological spends of their prospective clients.

Client captives have been growing faster with several big names in the financial services and retail sectors expanding their captive centres aggressively in India and South Asia. The Indian operations of global vendors like Cap Gemini, IBM and Accenture have been growing faster. The emergence of smaller digital-focused players and startups are also contributing to the margin erosions of larger tech services players.

Going by the huge number of employees laid off at the Tier I tech companies, volumes are not a veritable painpoint at this point of time. The layoffs are more a function of paring down their huge employee benches created down the last few quarters since 2015 by projects either not being extended or being scrapped altogether. The demand-side crunch in high-margin contracts is a larger factor. These contracts lie in the cloud consultancy space and emerging superstar verticals like artificial intelligence and machine learning, which are the power-plays of choice for multinational IT majors.

Companies which invested in servicing digital growth verticals and upgrading their employee skillsets to match the evolved demands of their clients will eventually benefit. But the pains involved in transitioning out from their traditional package-oriented bread-and-butter domains like systems maintenance, infrastructure management and apps development to platform-based services will persist like a recurrent bad dream. These services have clearly slowed down over the past eight quarters and are likely to stay slow for some time to come.

Better execution and handling of new verticals and sub-verticals will be key to maintaining some volumes while the traditional services continue in slowdown mode. Sub-verticals are opening up, thanks to GST and RERA-led issues, where innovation and efficient execution will matter.

Even as tech companies whittle down their benches to battle the dwindling number of high-margin projects, volumes will still matter, till things settle and the demand situation improves -- after which, improving margins through a stronger product-services mix and billing will probably be back on the agenda. In the interim, companies need to shed greater clarity on their overseas recruitment mix – the right ratio of highly skilled local programming and sales talent vis-a-vis consulting-focussed H1-B visa holders -- after trimming their onsite workforces for traditional services sharply and bringing skillsets to the top of the agenda.