The Indian stock market closed in red on Monday as heavy selling was seen in IT, pharma and media sectors on Nifty.

Sensex closed at 77,330.01 after falling 241.30 points or 0.31 per cent and Nifty closed at 23,453.80 after falling 78.90 points or 0.34 per cent.

Nifty Bank rose 184.25 points or 0.37 per cent to 50,363.80. Nifty Midcap 100 index closed at 54,044.80 at the end of trading after a nominal gain of 1.70 points or 0.00 per cent.

Nifty Smallcap 100 index closed at 17,507.25 after falling 93.80 points or 0.53 per cent.

Heavy selling was seen in Nifty's IT, Pharma, Media, Energy, Infra, PSC, Healthcare and Health & Care sectors. whereas, buying was seen in Auto, PSU Bank, Financial Services, FMCG, Metal, Realty and Private Bank sectors.

In the Sensex pack, TCS, Infosys, NTPC, HCL Tech, Axis Bank, Tech Mahindra, Bajaj Finserv, Sun Pharma, IndusIns Bank and Reliance were the top losers and Tata Steel, Hindustan Unilever Limited, Nestle India, M&M, SBI and Adani Ports were the top gainers.

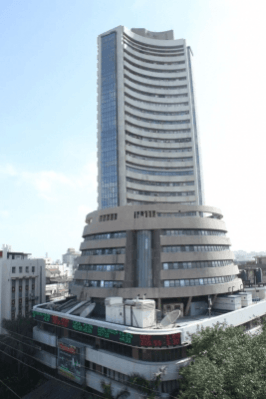

On the Bombay Stock Exchange (BSE), 1,617 stocks traded in green, 2,479 in red. There was no change in 128 stocks.

According to market experts, consolidation continued in the market; a slowdown in earnings growth and a weak rupee due to inflation impacted the sentiment.

IT stocks reacted negatively today due to a reduced expectation of a US Fed rate cut in December, which may pose a delay in spending in the BFSI segment.

Jatin Trivedi of LKP Securities said that selling pressure will be limited due to the upcoming state elections in Maharashtra.

"Rupee witnessed strength, trading 0.08 rupees higher at 84.39, supported by a weak dollar, which could not move above 107 and pulled back to 106.45. This marginal support for the rupee got further aggravated by reduced FII selling activity in recent days," he said.

(With inputs from IANS)