The first six months of the current financial year (H1, FY2017) were marked by a substantial reduction in debt for India Inc. On a standalone basis, corporate India trimmed Rs 95,000 crore, or 11 percent of total debt, based on an analysis of 4,000 companies, according to the latest issue of SBI Ecowrap. The impact on profit margins was direct: both operating and net profits shot up significantly, helped by 6.45 percent reduction of interest costs.

"While these entities have seen the positive effect of lower interest cost percolating down to the bottom-line, the topline is seeing some de-growth. The good thing is that despite reduction in net sales by 6.48% for the period H1FY17 vis–a-vis H1FY16, PBIDT improved by 22% and PAT by 68.5% during the same period for the same set of companies," Soumya Kanti Ghosh, Group Chief Economic Adviser and author of SBI Ecowrap, said.

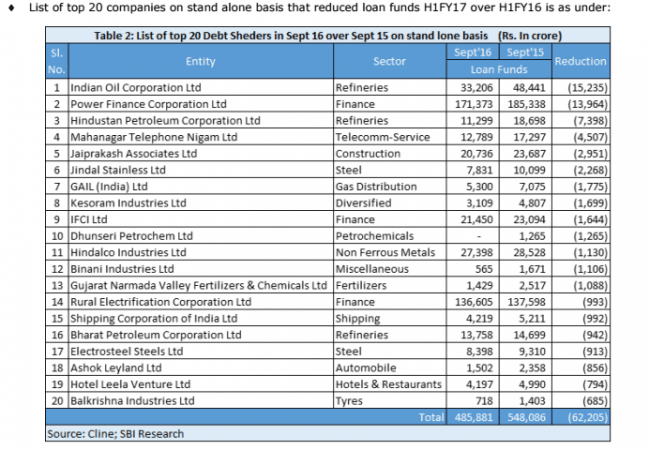

Companies in refinery, mining, infrastructure and telecom sectors are among those that retired debt during the first six months of fiscal 2017.

The negative impact on sales (topline) growth in H1 is continue to persist in H2 of FY2017 due to the fallout of the government's demonetisation decision.

While the list below shows companies that shed debt on a stand-alone basis, companies such as Vedanta, Reliance Communications, Larsen & Toubro and JSW Energy repaid their loans on a consolidated basis.