The income tax department has extended the deadline for bank account holders to June 30, 2017 for obtaining permanent account number (PAN). The notification extending the last date from February 28 to June end was issued on April 5.

Bank account holders can also furnish Form 60 in lieu of PAN card.

Also, those who apply for PAN from July 1 onwards will have to compulsorily provide their Aadhaar number while applying, under section 139AA of the Income Tax Act, as notified by the department on Wednesday (April 5, 2017).

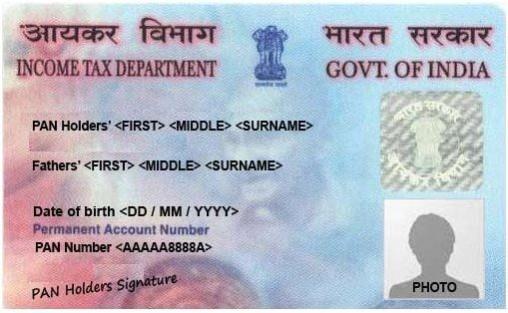

The income tax department has issued about 25 crore PAN cards till November 15, 2016.

Under Rule 114B of the Income Tax Act, PAN has to be quoted for the following banking transactions :

a. Deposit with a banking company or a co-operative bank in cash exceeding fifty thousand rupees during any one day.

b. Purchase of bank drafts or pay orders or banker's cheques from a banking company or a co-operative bank in cash for an amount exceeding fifty thousand rupees during any one day.

c. A time deposit with a banking company or a co-operative bank or a Post Office. Opening an account [other than a time-deposit referred to above or a Jandhan / Basic Bank Deposit Account] with a banking company or a co-operative bank.

Besides, the PAN has to be compulsorily quoted for many other transactions such as sale or purchase of vehicles, investment in mutual funds, buying or selling immovable property, among others.

As already known, during the demonetisation period (November 10 to December 30, 2016), banks were asked by the tax department to report all transactions above Rs 2.5 lakh in savings account and more than Rs 12.50 lakh in current accounts, as part of the move to track illicit money in the economy.

In another announcement, the department on Friday said that the crackdown on tax evaders and shell companies in the past three years has resulted in detection of more than Rs 1.37 lakh crore in tax evasion and transactions worth Rs 13,300 crore using Shell companies involving about 22,000 beneficiaries.