The latest announcement from the Central Board of Direct Taxes concerns, not the tax payers ironically, but the non-tax payers. Via a circular issued on Monday, the CBDT announced the implementation of Sections 206AB and 206CCA with respect to higher tax deduction/collection for certain non-filers.

![Income Tax calculation [Representational image] Income Tax calculation](https://data1.ibtimes.co.in/en/full/744121/income-tax-calculation.jpg?h=450&l=50&t=40)

The Income Tax Department shared a copy of the circular on its official Twitter account and posted, "CBDT issues Circular No. 11 of 2021 dt. 21.06.2021 on implementation of section 2016AB and Section 206CCA wrt higher tax deduction/collection for certain non-filers. New functionality issued for compliance checks for Sect 206AB & 206cca to ease compliance burden of tax deductors/collectors." The new sections take effect from July 1, 2021.

It must be recalled that the Budget 2021 had brought in a provision mandating that non-filers of income tax returns for the past two fiscal years be subjected to higher TDS and TCS rate if such deduction was Rs 50,000 or more in each of those two years.

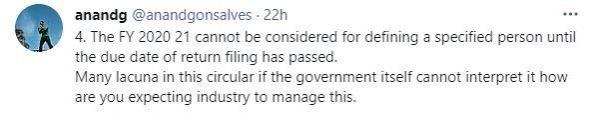

Accordingly, under the latest provisions, the list of specified persons will be prepared on the start of the financial year 2021-22, taking previous years 2018-19 and 2019-20 as the two relevant previous years. The list will contain names of tax payers who did not file their return for both these assessment years and have aggregate of TDS of fifty thousand rupees or more in each of the two previous years.

CBDT issues Circular No. 11 of 2021 dt 21.06.2021 on implementation of section 206AB & 206CCA wrt higher tax deduction/collection for certain non-filers. New functionality issued for compliance checks for sec 206AB & 206CCA to ease compliance burden of tax deductors/collectors. pic.twitter.com/1DP39BKVZi

— Income Tax India (@IncomeTaxIndia) June 21, 2021

Who is this 'specified person'?

The non-filers who fall under the ambit of specified person will be require to qualify two conditions. First being, "Who has not filed the returns of income for both of the two assessment years relevant to the two previous years immediately before the previous year in which tax is required to be deducted/collected." Two previous years to be counted are those whose return filing date has expired. Secondly, "the aggregate of tax deducted at source and tax collected at source is rupees fifty thousand or more in each of these two previous years."

Who is not a specified person?

To avoid ambiguity, the circular also mentions, "As per the provisions of Sections 206AB & 206CCA of the Act, the specified persons shall not include a non-resident who does not have a permanent establishment in India.

How to check if you are a 'specified person'

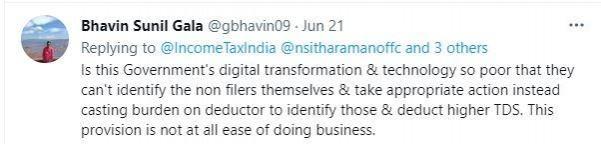

To ease the compliance burden of the central authorities, a new functionality has been introduced. As per "Compliance Check for Sections 206AB & 206CCA," available on the portal of the Income Tax Department. The tax deductor or the collector can feed the single PAN (PAN search) or multiple PANs (bulk search) and can get a response from the functionality if such deductee or collectee is a specified person.

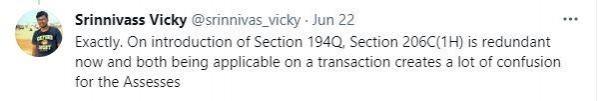

Tax payers react to the announcement

Many netizens also used the announcement to highlight and complain about the technical difficulties being faced on the portal.