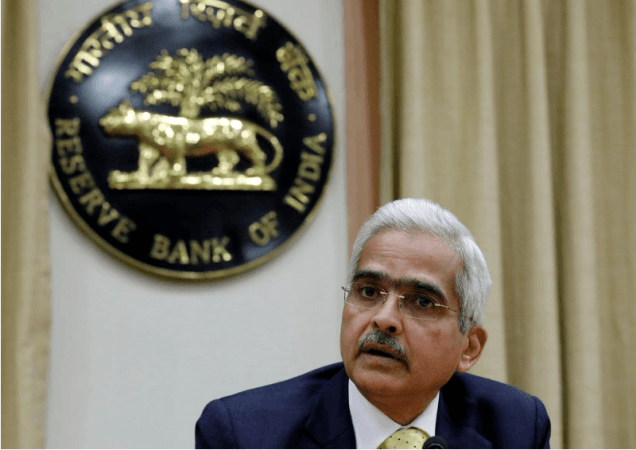

With the coronavirus outbreak bringing global economies to a standstill to impact on individual and business earnings, paying back EMIs is a huge headache for an average salaried or self-employed Indian. To address liquidity concerns for individuals and businesses availing loan facilities from financial and non-financial lending institutions, RBI Governor Shaktikanta Das announced on March 27, a moratorium on loans for 3 months, outstanding as of March 1, 2020, to be extended till May 31, 2020. This move by RBI is intended to help users struggling with liquidity and cash crunch.

Considering the Covid-19 is still not contained during the months post nationwide lockdown imposed on March 24 across India, RBI today has extended the moratorium period by another 3 months to now cover - June, July and August. It will now end on 31 August 2020. This makes it a total of six months moratorium on all loans from March 1, 2020, till August 31, 2020, applicable on home loans as well.

All lending institutions to include regional rural banks (RRBs), commercial private sector banks, co-operative banks, local-area and small finance banks, NBFCs including housing finance companies have been permitted by RBI to allow for a moratorium on all loans, including housing loans.

RBI has clarified that while the loan repayment schedule, subsequent due dates, and the tenor for all loans will be shifted by another three months, the moratorium placed in effect will not lead to changes in the terms and conditions of the loan agreements signed earlier.

What is a moratorium and how does it help meet immediate liquidity requirements?

A moratorium should not be confused with a waiver on EMI payments, but a postponement or deferment of activity to allow for payment by borrowers at a later date. In case, your installment payments on loans (EMIs) were due between March 1, 2020, and August 31, 2020, the RBI has now allowed banks/lending institutions to allow for the postponement of repayment for a longer period of time by six months.

However, not all banks are obliged to do so. Since different banks have different criteria decided during their time of establishment, some financial institutions may not allow for an EMI holiday for the next six months. Those banks that have already allowed for an initial three-month moratorium will continue to provide extension depending on the customer credit history.

A moratorium is not a new concept in the housing industry as most borrowers buying an under-construction property ask for a moratorium period. Banks who agree for a moratorium benefit usually offer up to three years, with an applicable condition that the borrower should pay the interest accrued during the moratorium period. This is also called the pre-EMI interest.

After the three years moratorium is completed, the borrower has to pay full EMI. In case of a ready-to-move-in property, banks typically offer a moratorium of up to three to six months only.

How will this moratorium affect home loan borrowers? How much will they have to repay in EMIs?

If you are availing of a moratorium on the home loan, then you will be paying the interest accrued over the period of the next three months, which will further add on to your liability. This means you will be repaying a higher amount with the future EMIs after a six months period, however, the moratorium on housing loan if availed now, will help you plan and rearrange your finances to cope with the crisis in the short-term.

The moratorium issued will be applicable both on principal and interest, whether you are paying pre-EMIs or EMIs. The applicable interest rate will keep on accruing on the outstanding portion of the loan amount during the moratorium period.

The advantage of seeking a moratorium on home loan should not ideally impact your credit score, but as rules vary from one financial institution to another, you should consult your bank about the impact of the moratorium on your credit score. There will be no penalty charged nor will your credit score be compromised on availing the moratorium extension on home loan EMIs from the bank.

In case you have multiple loan repayments to make, then the moratorium will be applicable on all term loans. You should be contacting the financial lending institution (your bank) at the earliest for clarity and more details.

For some borrowers, the extra interest accrued could be a small price to pay, but for some others like the self-employed borrowers will undoubtedly feel the pinch of repayments, since business activities have been disrupted owing to ongoing lockdown imposed in the wake of Covid-19 pandemic. Trying to resolve liquidity crunch at the moment by requesting for a moratorium on repayment from banks, does come at a hefty price of payback especially after the 3-month extension is once availed, and the impending arrears could give you sleepless nights

New borrowers can defer payment of EMIs up to 3 months, but since there is no waiver on accrued interest applicable, users are not getting any discount on repayments. If a borrower has registered with the bank for Electronic Clearing Service (ECS) mandate for the first week of a month, then the payment for March would have already been paid. This means the borrower can avail of only 2-months deferment of EMIs - April and May, in case of a three-month period.

Can a customer request for refund on EMI paid by ECS after March 27?

As the moratorium on loans and deferment of interest announcement was made by RBI on March 27, the ECS mandate and EMI payment processed by banks before this date will not be refunded. However, in case your payment was due on March 28, and the EMI amount was automatically debited from your bank account, then you can contact your bank for refunds.

Some banks such as ICICI Bank are more than willing to help customers during these crisis times, by assisting with refund settlements and processing moratorium requests. ICICI Bank guidelines read as follows, "EMI paid prior to Mar 27, 2020, will not be refunded. However, if any EMI is debited after Mar 27, 2020, and the borrower customer opts for moratorium then such EMI may be considered for refund at the request of the borrower/ customer."

Are NRIs eligible for moratorium benefit?

Even NRI customers can avail of the moratorium facility and request banks to process the same. State Bank of India (SBI) has made it possible for all borrowers to avail of a moratorium, whether they request for it, need it or not.

More clarity is awaited from other banks, who are busy preparing policies to be approved by their board and provide this convenience to all eligible borrowers. If your bank does not offer a moratorium on home loans, then you may be at risk of losing your property in case of defaulting on EMIs.

Ensuring liquidity for banks and those investing in real estate

"The moratorium on housing EMI's and deferment of interest payments by another three months will give a lot of relief to consumers as they can now rearrange their finances. Another repo cut by 40 basis points to 4% is also a welcome move. With the cost of funds coming down for banks now, borrowers will stand to gain as the EMIs on their home loan are expected to fall. This is another big announcement which will ease liquidity pressure for developers. However, the quick transmission will be key to the huge liquidity infused by RBI. All these measures augur well for the real estate sector during such trying times. We hope that the government will continue to take all the necessary actions in the near future for the betterment of the overall economy. The current scenario offers excellent investment opportunities in residential real estate as affordability is at an all-time high. The post-pandemic world will be good for the real estate sector, the one sector that will emerge as the silver lining in such a bleak scenario and offers you the best bet - stability, security and safety," says Surendra Hiranandani, Chairman and Managing Director, House of Hiranandani.

"To control the inflation and inject more liquidity in the market, a further rate cut is expected as the market is unstable and there is a minimal sign of growth. The growing economic and financial stress will see a massive reduction and the measures overall will help bring in financial stability," says Ashok Mohanani, Chairman, EKTA World & President-Elect NAREDCO, Maharashtra.

Considering the accrued interest on a moratorium on home loans and the loan against property, which could be significantly higher with long residual tenure and sizeable outstanding loan amount, those with sufficient liquidity should consider servicing their loan payments on time to avoid heavy accrued interest charges.

Also, RBI has increased the export credit period to 15 months from 1 year and extended Rs 15,000 crore line of credit to EXIM Bank. This will help ease the liquidity situation with import-export companies. Further, rate cut and reverse repo rate cuts are moves in the right direction. These measures should help revive economic growth positively in H2 FY21.