Mukesh Ambani led Reliance Industries has achieved an important goal. The Oil to telecom conglomerate today announced that the company has become net debt-free eight months ahead of March 2021 deadline it had set for itself. The company had set this target to become debt-free by FY21 in last year's Annual General Meeting.

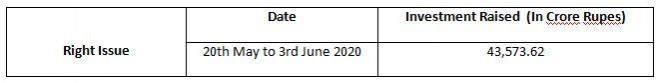

Notably, at the end of the last financial year, RIL's net debt stood at Rs 161,035 crore. Within the next few weeks, the company earned a cumulative investment of 115,693.95 crores from 11 deals struck by Reliance Industries for its digital unit, RJio Platforms. Moreover, the company also gained another Rs 53,124.20 crore by RIL's right issue.

In an official statement, the company said, " RIL raised more than Rs 168,818 crore in just 58 days through Rs 115,693.95 crore collected from investors in Jio and another Rs 53,124.20 crore from a rights issue. Along with the stake sale to BP in the petro-retail JV, the total fundraised is in excess of Rs 1.75 lakh crore."

Rs. 1.6 lakh crore in 58 days

In less than 2 months, the company managed to secure investments around 1.6 lakh crore through 11 investors and the Right issue. The process started on 22nd April where Facebook, Inc bought a 9.99% share at a cost of Rs. 43,573.62 crore. On 4th May, Silver Lake Partners invested Rs. 5655.75 crore for 1.15% share in RJio. Just after 4 days, the company signed a deal to shed a 2.32% share at a price of Rs. 11,367 crore to Vista Equity Partners.

General Atlantic, an American private equity firm pumped Rs 6,598.38 crore for 1.34% stake in RJio on 17th May. In the next month, the company earned in total Rs. 1.15 lakh crore from investors including KKR, Mubadala, Abu Dhabi Investment Authority, L Catterton, TPG, and PIF. Another Rs. 53, 124 crores was raised via issue rights.