Banks are not only facing competition from Fintech companies but also from large technology companies (BigTechs) that are entering into the financial services industry in a big way. Building on the advantages of the reinforcing nature of their data-network activities, some BigTechs are venturing into payments, money management, insurance and lending activities.

At present, financial services are only a small part of their business globally. But given their size and reach, their entry into financial services has the potential to bring about rapid transformation of the financial sector landscape. This might, of course, bring about many potential benefits. Using big data, the BigTechs can assess the riskiness of borrowers, thus reducing the need for collateral. Hence, their low-cost structure business can easily be scaled up to provide basic financial services to the unbanked population.

Emerging structure of the 21st-century banking

Distinct segments of banking institutions may emerge in the coming years. The first segment may consist of large Indian banks with a domestic and international presence. This process will be augmented by the merger of Public Sector Banks (PSBs).

The second segment is likely to comprise several mid-sized banking institutions including niche banks with economy-wide presence. The third segment may encompass smaller private sector banks, small finance banks, regional rural banks and co-operative banks, which may specifically cater to the credit requirements of small borrowers in the unorganised sector in rural/local areas.

The fourth segment may consist of digital players who may act as service providers directly to customers or through banks by acting as their agents or associates. The reoriented banking system will, of course, be characterised by a continuum of banks. The banking space would also include both traditional players with strong customer base and new technology led players.

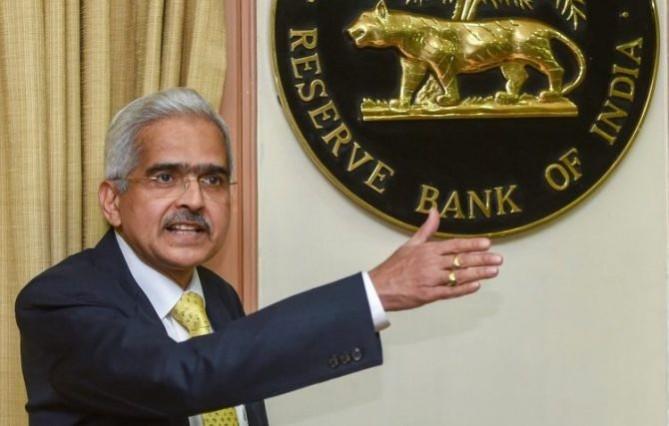

"In the context of the emerging scenario, a properly worked out consolidation of public sector banks can generate synergies in the allocation of workforce and branches as well as streamlining of operations to meet the future challenges. The focus has to be on ushering in significant improvements in efficiency and rationalisation of scarce capital to meet the capital adequacy requirements. Investments in technology and skill-building have to be stepped up. Bigger and agile banks may be able to reposition themselves with better branding exercises, backed by improved technology, skills and business models," Das opined.

Ultimately, the strength of a banking system depends on the strength of its corporate governance that fosters a robust and ethics-driven compliance culture. In this context, the Reserve Bank has been issuing instructions on corporate governance. For example, the compensation guidelines for whole-time directors, CEOs and material risk-takers of banks have also been substantially modified. Large-scale divergences and frauds observed across banks are raising questions on the role and effective utilisation of internal control systems within banks to identify areas of emerging risks.

The RBI has issued the revised guidelines on the concurrent audit system in banks, drawing from the recommendations of the Expert Committee under Shri Y.H. Malegam. The guidelines are aimed at strengthening the internal control functions adjoining greater responsibility on the audit committees of the Boards while providing them with greater leeway.

Embracing Digitisation

Digital disruptions will continue to transform the banking sector. Initiatives undertaken by the Government, the Reserve Bank and the industry have led to a radical shift towards ubiquitous digitization, which has provided an impetus to adoption of technology. There is a unique confluence of several positives like demographic dividend, JAM trinity, etc., that would further support rapid digitisation of financial services in India.

Banks and non-banks are partnering to offer the combination of trust and innovation to the Indian consumer. This "best of both worlds" approach has resulted in tremendous growth in the number of digital payments, which is expected to continue. Conventional banking is making way for next-generation banking with a focus on digitisation and modernisation. The need for brick and mortar branches is being reviewed continuously as digitisation has literally brought banking to one's fingertips, obviating the need to physically visit a bank branch for most of the banking services.

Each day on an average, the payment systems in India process more than 10 crore transactions of nearly INR 6 lakh crore. Today, digital payments account for around 97 percent of daily payment system transactions in terms of volume. This has been made possible with accelerated growth of over 50 per cent in the volume of digital payment transactions in the last five years.

Towards the Future

The changing landscape of the banking industry will unfold in the backdrop of a strong regulatory and supervisory regime with increased intensity and tech-enabled supervision of banks. The challenge before banks is to make the best use of technology and innovation to bring down intermediation costs while protecting their bottom lines.

Further, Artificial Intelligence (AI), Machine Learning (ML) and Big Data are becoming central to financial services innovation. They can also help in fraud detection and in identifying better ways of monitoring use of funds by borrowers, track suspicious transactions, etc. by processing large datasets. Advanced analytics and real-time monitoring of emerging cybersecurity risks will be critical in detecting potential threats and enabling pre-emptive action.

Das concluded saying, "As the Indian banking sector is propelled forward to a higher orbit, banks would have to strive hard to remain relevant in the changed economic environment by reworking their business strategies, designing products with the customer in mind and focusing on improving the efficiency of their services. The possibilities are enormous. We should be seized of the issues and act in time."