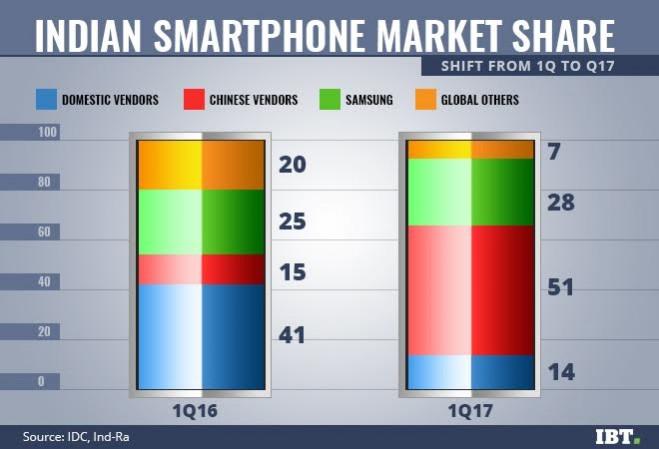

The increasing dominance of Chinese players in the Indian smartphone market is reflected in their rapid growth rate which increased 3.4 times taking the market share to 51 percent in the first quarter of the year 2017 (1QCY17).

Samsung Electronics has held the top position as the market leader with 28 percent share in the 1QCY17, while the market share of Indian vendors has been downsized to a mere 14 percent from last year's 40 percent.

There has been a massive change in the market position of the top five smartphone players in the financial year 2017 (FY17), as Xiaomi, Vivo Mobile India, and Oppo Mobiles India have dethroned Micromax Informatics, Lava International, and Karbonn Mobiles from the top five list.

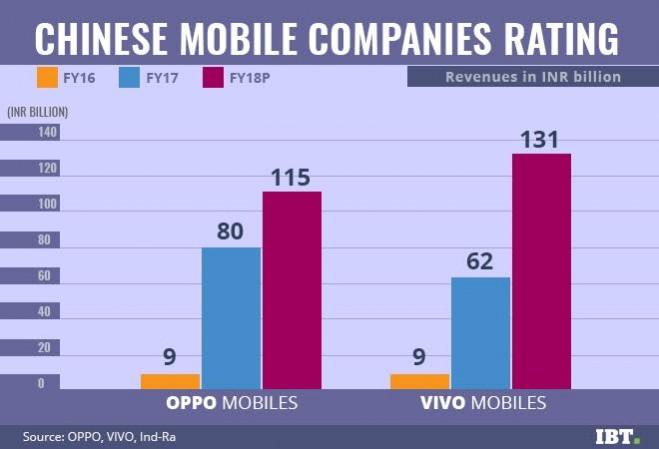

Meanwhile, Lenovo has retained its position owing to its established brand and product line-up placed in diversified price segments. Oppo and Vivo India have seen massive growth with their smartphone sales which increased by seven to nine times in the FY17.

According to the latest India-Ratings report, Vivo India and Oppo's smartphone sales are expected to grow by around 40-50 percent over FY18.

The secret to the phenomenal success of Chinese players can be attributed to their strong marketing and sound advertising strategies that are fully backed by the sponsors. They also enjoy a debt-light capital structure and solid liquidity driven by long payable periods extended by their suppliers.

The cutting-edge technological prowess of the Chinese players in making superior product offerings at lower prices has also contributed to their unparalleled success. Massive investments by Chinese players towards brand building and manufacturing facilities in India points to their long-term strategic intent.

The report further adds that the domestic players will face an elevated stabilisation risk owing to their increased operating costs, slower progress with product innovation, and fierce competition from Chinese players.

Rising demand for VoLTE handsets

Reliance Jio's free data and voice service offer in the second half of the financial year 2017 have pushed up the demand for 4G VoLTE enabled smartphones. The demonetisation effect also had its share of slowing growth in the smartphone market, besides resulting in liquidity shock for domestic smartphone players.

Nevertheless, the highly competitive data prices from incumbent telcos for 4G smartphone users has paved the way for increased sales of VoLTE enabled smartphones. Consequently, it triggered a rise in demand for migration from 3G to 4G and thereby pushed a faster migration from feature phones to smartphones.

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)