Automaker Renault has officially announced that it will pass on the benefits of the Goods and Services Tax (GST) rates to customers in India. Customers now stand to enjoy up to 7 percent price cut on Renault models sold in the country. However, the range of benefits will vary depending on the state, the basis of the tax rates applicable prior to the roll out of the GST, model and the variant of the car being purchased.

According to Sumit Sawhney, Country CEO and Managing Director, Renault India Operations, the rollout of GST from July 1 can be considered as one of the biggest achievements of the Central Government. Calling it a facilitation of a 'one nation-one tax' system that aimed at fostering a congenial business environment, he noted that there may be a short-term disruption as the whole system adapts to this economic transformation, but in the long term it will be very positive for the economy and corporate India. "To reflect our customer-first approach, we have decided to pass on GST benefits to our customers, further enhancing the value proposition of our products," he concluded.

Also read: GST effect on cars, bikes, scooters & SUVs: What will come cheaper and what will cost more?

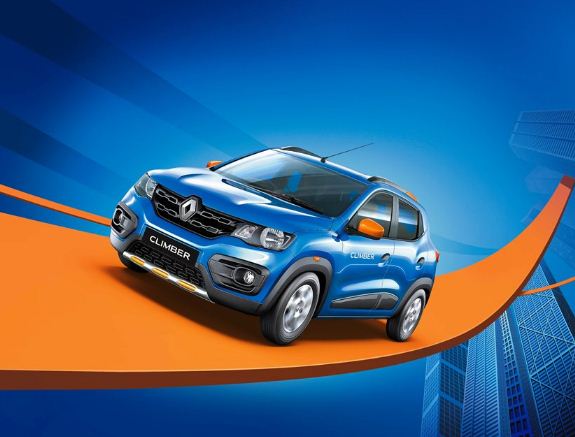

The prices of Renault Kwid Climber AMT between has come down between Rs. 5,200 and Rs.29,500 while the company's popular SUV Duster RXZ AWD gets a price cut in the range of Rs. 30,400 to Rs. 1,04,700. Lodgy Stepway RXZ (7S) prices dropped by up to 88,600.

Following the rollout of GST, small cars under four-metre get a tax of 29 percent as opposed to the previous 31.5 percent. The cars with more than 1.2L petrol and 1.5L diesel engine capacity will be taxed at 43 percent, which is almost two percent down from the previous 44.7 percent tax slab. Looking at the tax rates on the SUVs in India, the tax has come down by 12 percent at 43 percent while electric cars stand as the highest gainers with the tax rate on these models being lowered to 12 percent from 20.5 percent.

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)

![India Auto Roundup: Maruti Suzuki, Mahindra have exciting launches in November [details here]](https://data1.ibtimes.co.in/en/full/805520/india-auto-roundup-maruti-suzuki-mahindra-have-exciting-launches-november-details-here.jpg?w=220&h=135)