With Goods and Services Tax (GST), the biggest tax reform since independence, the prices of small cars, bikes with engine capacity below 350cc, scooters and SUVs set to become cheaper.

While many of the auto and two-wheeler makers have already announced their decisions to pass on the expected benefits of GST to customers, others are still working out on the new tax structure before they make an announcement on the price revisions.

According to the Times of India, many companies are expected to revise the prices of their offering in the country on Saturday, while others might wait till Monday, July 3, to update their software and tax mechanisms.

What will come cheaper and what will cost more?

Cars, SUVs, bikes, scooters to come cheaper

Also Read: GST effect on two-wheelers: Will bike and scooter prices come down?

When it comes to cars and SUVs, all the small cars under four-metre and powered by petrol engines less than 1.2-litre capacity will now cost less as the tax under GST comes down to 29 percent from the previous 31.5 percent. The same also goes for cars under four-metre and powered by diesel engines less than 1.5-litre capacity. The cars in the category will now attract a tax of 31 percent as opposed to the previous 33.25 percent.

The other segment, which will also see price cut under the new tax regime is the cars with more than 1.2L petrol and 1.5L diesel engine capacity. Under GST, the tax in this segment of cars will come down to 43 percent, reduction of almost two percent from the previous 44.7 percent tax. Cars with more than four-metre length and bigger engines will also stand to yield the benefits from GST as the tax will come down to 43 percent from the previous 51.6 percent. The biggest beneficiaries are the SUVs in India as their tax set to come down by 12 percent at 43 percent. Electric cars will now become even more affordable with the GST set to bring down the tax rate on these models to 12 percent from 20.5 percent.

The biggest beneficiaries are the SUVs in India as their tax are set to come down by 12 percent at 43 percent. Electric cars will now become even more affordable with the GST set to bring down the tax rate on these models to 12 percent from 20.5 percent.

Also Read: GST effect: Should you delay buying car till July 1?

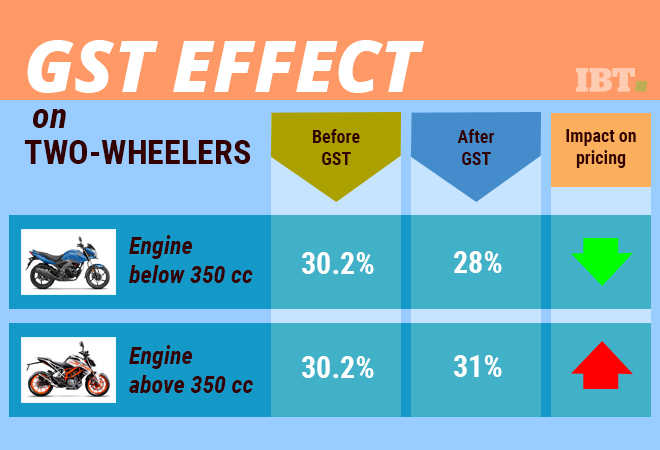

Coming to the two-wheelers, all the scooters, except Aprilia SRV 850 ABS, which is also the most expensive scooter in India, fall in this category. Under GST, the tax rate of scooters and bikes with less than 350cc engine capacity will go down to 28 percent, which is lower by about two percent than the previous tax of 30.2 percent.

What is going up?

Under GST, hybrid cars like Toyota Camry Hybrid, Honda Accord Hybrid and Lexus' hybrid range are going to be costlier as the tax is set to go higher to 43 percent from 30.3 percent. The bikes above 350cc engine are another segment, which will now attract a tax rate of 31 percent from the previous rare of 30.5 percent. That means bikes of Triumph, Harley-Davidson and Ducati will now cost more.

![India Auto Roundup: Maruti Suzuki, Mahindra have exciting launches in November [details here]](https://data1.ibtimes.co.in/en/full/805520/india-auto-roundup-maruti-suzuki-mahindra-have-exciting-launches-november-details-here.jpg?w=220&h=135)