Update at 6.50 PM: The GST Council has finalised tax rate on gold at 3 percent.

GST for Gold to be 3%, footwear below Rs 500 to be taxed at 5% &footwear above Rs 500 at 18% & Bidi to be taxed at 28% without cess: Sources

— ANI (@ANI_news) June 3, 2017

The All India Gems and Jewellery Trade Federation had pitched for 1.25 percent GST on gold. Currently, the import duty on gold is 10 percent that will remain unchanged, while states charge about 2 percent as value added tax (VAT), with Kerala's VAT on gold at 5 percent is the highest.

Also read: All you need to know about Goods and Services Tax (GST)

Update at 6.39 PM: Though a decision on GST rate for gold is yet to be taken, the Council has finalised the rates for biscuits, textiles, footwear and beedis, reports Bloomberg, citing a source.

Here are the GST rates, according to the news agency:

Footwear below Rs 500 at 5 percent, above Rs 500 at 18 percent.

Biscuits - 18 percent.

Beedis - 28 percent, without cess

Readymade garments - 12 percent, cotton textiles - 5 percent.

Read: Modi govt rules out postponing GST implementation date

A view of the participants of 15th GST Council Meeting which is being held in the national capital today. pic.twitter.com/LXOnKXjzXc

— Ministry of Finance (@FinMinIndia) June 3, 2017

The Council also took a decision on raising the input tax credit limit from 40 percent, though the revised limit is not known. "Although there is no update regarding increase of deemed credit from 40 percent, planning business transition to GST with the help of transition rules should now be on the agenda for all businesses," Rajeev Dimri, Leader, Indirect Tax, BMR & Associates LLP, said in a note on Saturday.

"It has been confirmed that a committee would be set-up for monitoring the anti-profiteering element, detailed rules on these aspects may also emerge later," he added.

Update at 4.18 PM: The GST Council said it was firm on implementing the indirect tax regime from July 1, laying to rest concerns and opposition expressed by West Bengal.

"We were discussing the rules and [they] have been completed. Transition rules have been cleared and everybody has agreed for a July 1 rollout," news agency PTI quoted Kerala Finance Minister Thomas Isaac as saying at a press conference in New Delhi.

A few days ago, West Bengal chief minister Mamata Banerjee had said that her state won't accept the GST rules and regulations in their present form.

Original story

The most-awaited meeting of the Goods and Services Tax (GST) Council begins in New Delhi on Saturday. The apex decision-making body is expected to finalise the tax rates on gold, textiles, biscuits and footwear, besides taking other items on the agenda.

"This meeting is important because it is likely to finalize the rates of tax and cess to be levied on the commodities remaining after the fitment exercise in the 14th GST Council Meeting. Besides it, approval of amendments to the draft GST Rules and related Forms are also on the agenda among others of the aforesaid one day meeting," the finance ministry said in an update on Friday.

As already reported, the GST is all set to be rolled out from July 1, 2017.

The government opened a Twitter handle askgst_goi last Sunday to answer queries.

While the import duty on gold will remain unchanged at 10 percent, the GST rate on the yellow metal is likely to be fixed either at 5 percent or 12 percent, as against the current value added tax (VAT) of about 1.50 percent levied by the states, the highest being in Kerala, at 5 percent.

India Inc. not ready for GST, wants postponement

In a related development, a poll conducted by business channel CNBC-TV18 and BMR Advisors found that 43 percent respondents wanted the implementation date of July 1 to be deferred by at least two months. Further, 49 percent of the respondents comprising CEOs, CFOs and COOs said they have not finalised the transition to the new indirect regime.

While more than 50 percent of the respondents expressed confidence that the GST regime will bring benefits to their businesses, 27 percent thought otherwise.

Some queries posed on GST Twitter handle:

@askGST_GoI

— rajesh kumar.c (@rajeshkumarc1) June 2, 2017

What will we do if goods once sold is returned by customer, especially if he ask for money back and in case of change the item.

@askGST_GoI By Mistake I had Migrated with Incorrect Ward/Circle/Sector No. What will be the impact... How can i change & update Word.

— Adv. Nilesh H. Rajai (@adv_nilesh_bvn) June 2, 2017

Signature via EVC is not working at all! Please look into the issue and fix the bug ASAP! #GST @askGST_GoI @FinMinIndia @arunjaitley

— Vaibhav Jain (@VaibhavJain1401) June 2, 2017

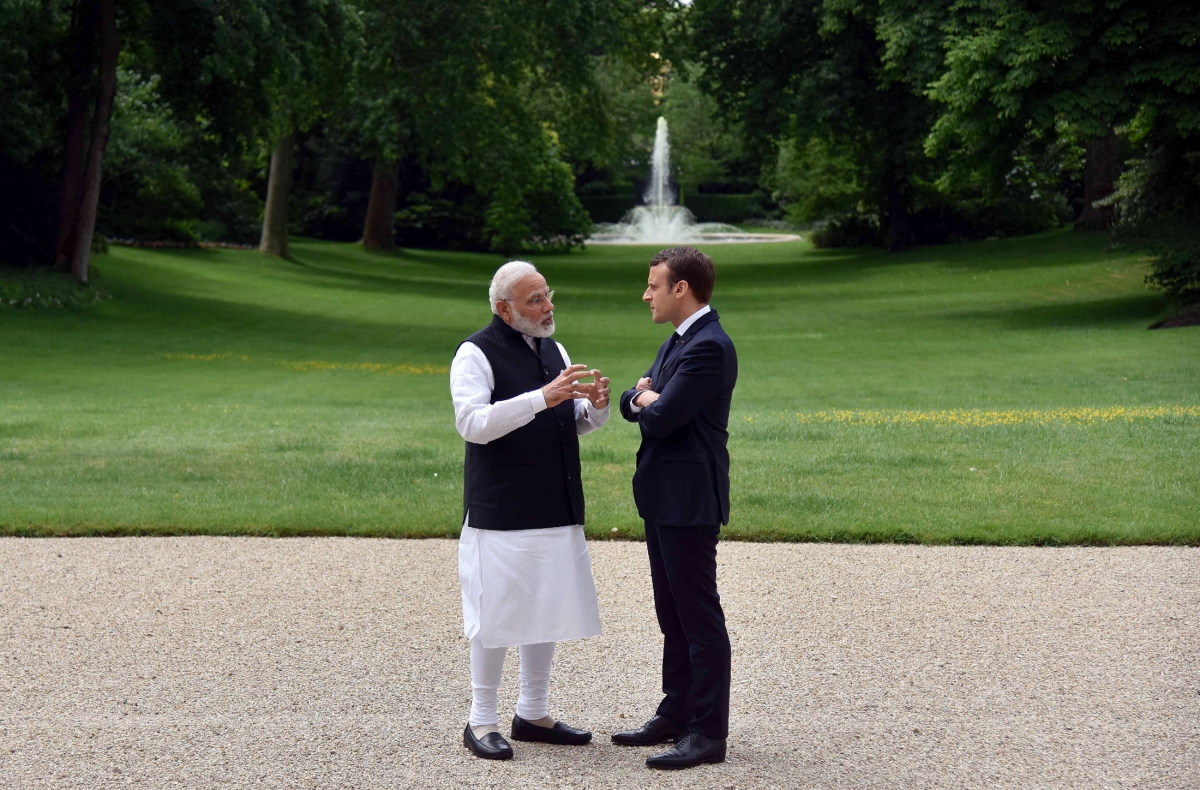

Some photos of Prime Minister Narendra Modi's overseas visit: