The Narendra Modi government had implemented the Goods and Services Tax (GST) in July 2017. Even after a year of implementation of the new tax regime, many are confused on how it works.

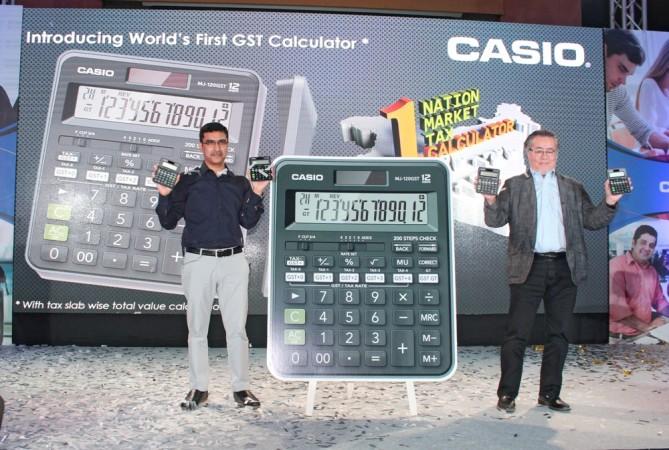

Japanese multinational consumer electronics firm Casio has surveyed different Indian markets to understand the nuances of the invoicing process over the past year and come up with an easy solution. It has introduced two new calculators which are billed as the world's first GST calculator.

Christened MJ-120 GST and MJ-12GST, the new calculators have been designed for the Indian market and priced at Rs 398 and Rs 475, respectively. Casio claims the new calculators are ideal for anyone dealing with GST-based invoicing. Here are the features.

In-built GST tabs - All the five GST slabs (0%, 5%, 12%, 18% and 28%) are in-built in MJ-120GST and MJ-12GST. There are separate buttons for the GST slabs which are expected to reduce the number of clicks, hence reducing the time required to generate an invoice. In addition, the tax slabs are also changeable as per the industry needs.

Gross value (net value + tax) - Net value and tax paid under different GST slabs stay stored in the GST+0, GST+1, GST+2, GST+3 and GST +4 buttons and the overall value in the five slabs stays stored in the GST GT button. This eschews recalculation of the values repeatedly.

Tax-mode application – The taxpayers and traders in the different markets calculate the base value of products by deducting tax from MRP. Hence, a tax feature for all the five tax slabs to calculate the base value from MRP is also added in the new calculators. Tax-mode has its application in calculating the base value and net profit earned.

Multi-industry use - The functionality of the GST+/tax- key makes MJ-120GST transcend industries as it can calculate values in multiple formats that include the gross value from the base value in GST+ mode and base value from the gross value in Tax- mode. In addition, the GST GT key is for calculating the gross value of a GST-based calculation and can it can also be used for calculating the grand total of a calculation.