Remember the demonetisation drive that the Modi government so gracefully implemented? Apart from leaving millions of people cash-less it actually benefitted the cash-less economy, or should we say, the e-payments market. And right now, even the world's largest search engine, Google wants a piece of the e-payments market in India.

In a market flooded with e-payment apps such as Paytm, Freecharge and PhonePe, Google's aptly named "Tez" (which means fast in Hindi) is the newest entry. Backed by Google's technical prowess, how will "Tez" take on the likes of Paytm, which enjoys a majority share of the e-wallet market?

Paytm has been in the Indian market for almost seven years. The app gained formidable success with last year's surprise demonetisation. A direct comparison between a "been-there-done-that" app like Paytm and the newly-launched Tez would suggest that the Paytm has an upper hand, but Google Tez must be hiding some pretty interesting tricks up its sleeves.

Google Tez vs Paytm

To begin with, both Paytm and Tez work differently. Although both facilitate e-payment, the way they do so is entirely different. While Paytm is a full-fledged "e-wallet", Tez, on the other hand is a kind of mediator which facilitates easy access to your bank account for making payments.

How Paytm works

Paytm is basically a mobile wallet or an e-wallet, where money is stored in the app and needs to be topped up once the cash runs out. With Paytm, the user is required to "add" money into the app beforehand, which can be done from the linked bank account or from Paytm-to-Paytm transfers. The saved amount reflects as Paytm balance and whenever the user makes a payment using the app, the amount gets deducted from the existing Paytm balance.

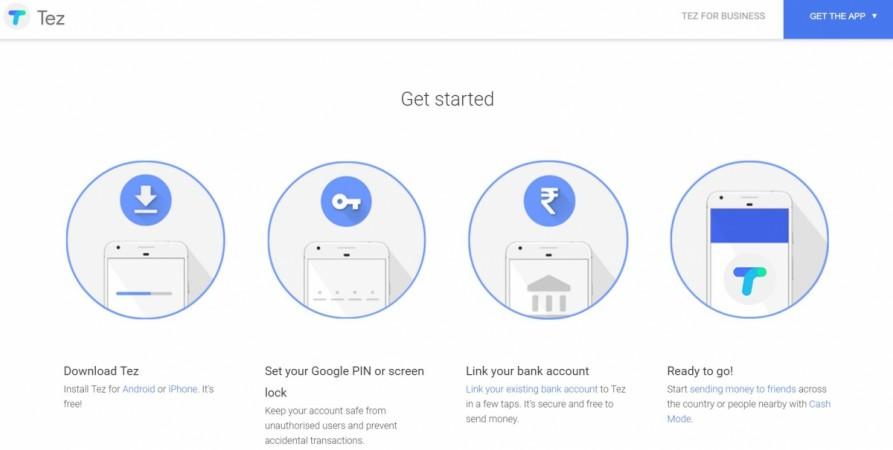

How Tez works

Google Tez will not store any of the user's money, at least not right now. Instead, Tez connects to the user's bank account using the Indian government's Unified Payment Interface (UPI), that allows real-time money transfer across any bank account in India. There are over 50 banks that are partners of UPI, including SBI, HDFC and ICICI Bank.

With Google Tez, the user's bank account is directly linked to the app and any payments made for purchases or any phone-to-phone money transfers get deducted directly from the user's bank account. A user can protect the app either by a pattern lock, or with a 4-digit PIN. Once done, the app requires the user to follow a few simple steps to set-up the account. The user then needs to add his bank account details in order to link the app directly to the bank account.

Advantages of Google Tez

Google Tez comes with Google's proprietary AQR or Audio QR technology, which is a sound-based format for transferring money securely between devices. Google has used AQR for payments for the first time with Tez. It had earlier used the technology for transferring information between devices.

The Audio-QR technology is a step-forward in secure e-payment, as it uses ultrasonic sound unlike Near Field Connectivity (NFC) which requires a NFC-enabled smartphone to make the payments. Paytm also provides the option of making payments using a QR code, but then again, using the option requires the user to turn on the camera and physically align it with the code on another screen, which is a potentially fiddly and difficult process.

Tez also offers a bigger transfer limit of Rs. 1,00,000 per day across all UPI apps and up to 20 transfers in one day. Paytm, however, offers a Rs 20,000 monthly usage limit for regular Paytm users.

Advantages of Paytm

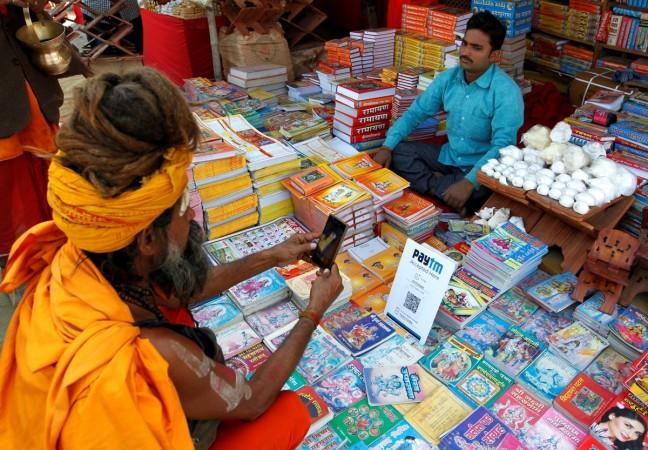

Paytm has been there for almost 7 years and it enjoys the first-mover advantage. It is widely accepted and used by almost everyone including the local shop owners to petrol bunks and what not.

Perhaps the most important advantage of using an e-wallet over an app that is directly linked to your bank account is that, if there is a breach ever, the bank account will not be compromised. As the money is already saved in the app, sparing the bank account of any security threat.

The worst-case-scenario in apps like Paytm will be -- the user may end up losing only the money that's left in the e-wallet. In case of a breach in an app that relies on UPI framework like Tez or BHIM, there is a high chance of the linked bank account getting compromised. Also, Paytm has the option to add your debit/credit card to your Paytm account, just in case you run out of your Paytm(read e-wallet) balance.

So which one is better, Tez or Paytm?

It's up to the user to choose between the two different payment modes. While Paytm is essentially an e-wallet that requires you to maintain a balance, Tez acts like a direct link to your bank. For some users the UPI method by which Tez works seems to work fine. For others, e-wallets seem to be more convenient.

But as of now, Paytm with its wider acceptance and deeper penetration in the Indian market seems to have a upper hand. It also gives you the option to use your credit card, somethingh that Tez doesn't seem to do, at least as of now.