Indian Prime Minister Narendra Modi's vision for a cashless economy is gaining foothold with growing number of convenient ways to transact online. From bank apps to e-wallets and now UPI payment apps, users have the means to perform daily financial transactions without having to step inside a bank or an ATM.

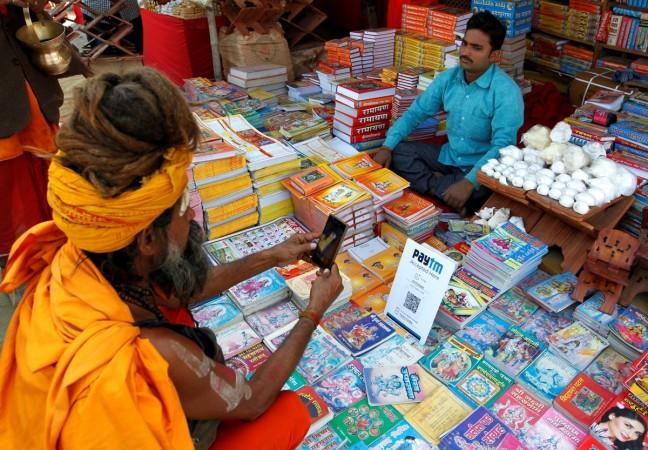

Soon after the Indian government banned Rs. 500 and Rs. 1,000 notes last year, use of Paytm skyrocketed and has since expanded to all small and medium businesses. From vegetable vendors to pharmacies and even restaurants, Paytm is widely accepted across India.

Google, the world's largest web search titan, launched Tez mobile payments app in India on Monday, joining the long list of digital wallets and payments solutions including MobiKwik, Paytm and BHIM app. But the new app is trying to be different than the rest, with the question rising will users go for it?

Despite of being on different playing grounds, Google Tez and Paytm are somehow competing against each other. But then comes the question of practicality, which is what we are trying to answer here.

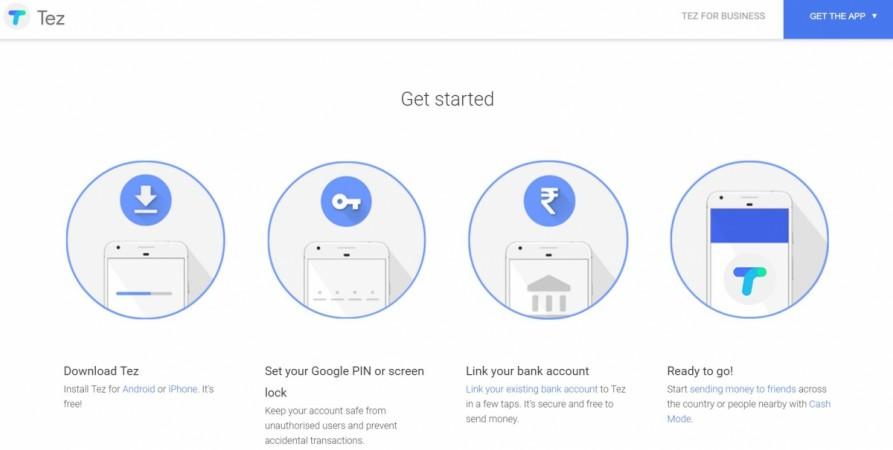

Google Tez is the new kid in the block with some powerful backing. Since users are quite familiar with Paytm, let's take a quick course on what Tez offers to gain supremacy in the digital payment system in India.

Google Tez is basically a unified payment interface (UPI) app, just like the government's very own BHIM app. But it has some extra features to stand out in the crowd. To push the app to maximum users, Google is offering up to Rs 9,000 as reward for referring people to start using Tez.

Since Tez gets UPI support, users can directly transfer money from one bank to another bank account at no charge. Getting paid or paying up someone has never been easier. Google Tez works with 55 leading Indian banks including ICICI Bank, SBI and HDFC Bank.

But Google wants to be more than a UPI-based payment solution to Indians, so it added two more methods of payments. Drawing a page from Paytm, Tez allows users to pay simply by scanning a QR code.

And there's another useful method of payments in Tez, which is the Cash mode. With this, users can send or receive money without requiring a bank account number or phone number. The Cash mode in Tez works based on audio and proximity to share money when both parties are closeby.

To attract the Indian crowd, Tez supports local languages such as Hindi, Bengali, Gujarati, Kannada, Marathi, Tamil, and Telugu. These features certainly give Tez an edge over its rivals, be it Paytm or any other app.

But that doesn't throw Paytm out of the playing field. Paytm is far stronger than Google Tez at the moment. There may be a time when Tez might catch up to Paytm, until then Paytm is dominating this field.

Paytm is not based on UPI, which makes it different than Tez and BHIM apps. This helps Paytm build the app and user experience from the ground up. It has its own system in place and quite a successful one at that. Anyone who has used Paytm would know that sending and receiving money is as simple as navigating through a few user-friendly options.

The biggest advantage Paytm has over Tez is that users can use credit card with Paytm. In case of Tez, if you have money in your bank, you have it in Tez. Also, your Paytm e-wallet is different from your bank account, which means in case of a breach, your bank accounts are safe.

But in terms of practicality, Paytm is much more convenient than Tez at the moment. Paytm not only helps transfer money, it also allows various services like paying bills, recharging mobile numbers, and also has integrated e-commerce for shopping. If you are willing to argue against Tez's reward system, Paytm has been offering attractive cashbacks on purchasing products from its platform.

UPI may well be the future of digital payments, but Paytm clearly leads the way at the moment. If you're looking for a user-friendly service with a wider availability, Paytm is your solution.