Prime Minister Narendra Modi's Digital India initiative will get another boost in the days to come as the world's largest internet search company brings UPI payment system in the country. While the country tries to get its head around the Goods and Services Tax (GST), Google India will soon make a digital approach to render cash payments obsolete.

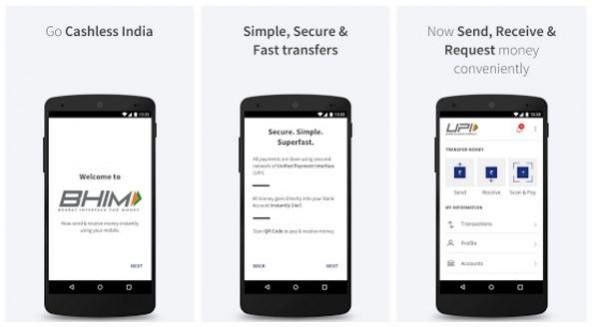

Ever since PM Modi launched Aadhar-based BHIM mobile app in December to make digital payments seamless, the Unified Payments Interface or UPI system has gained a significant boost. From Reliance Retail stores to universities, UPI payments are being promoted extensively. Google India will join the rally with its own UPI app for hundreds and thousands of netizens in the country, Zeebiz reported.

While Google remains mum on the subject, AP Hota, MD and CEO, National Payments Corporation of India (NPCI) revealed that Google has completed UPI system testing and it will be launched soon after the Reserve Bank of India (RBI) gives a green light to the service.

But Google won't be alone. Reports have long speculated that Facebook-owned WhatsApp has been developing its own UPI payment system. The world's largest cross-platform instant messaging app, which has more than 200 million active users in India, is expected to launch its service later this year.

While it will be a tough battle for Google against WhatsApp and government's own BHIM app, end users will benefit from a wide range of options. At a time when the government is hell-bent on making most of the transactions cashless, the new UPI system is a welcome move.

UPI allows users to transact with multiple banks using a single mobile application. Instead of having a separate app for different banks, UPI combines several banking features into one and enables seamless fund transfers, merchant payments, peer-to-peer collection requests and much more.