![[Representational image] sensex closes above 30,000 nifty at record high, buzzing stocks, indian stock markets, rupee at 20 month high, sensex stocks, stocks at 52 week high](https://data1.ibtimes.co.in/en/full/631292/bse-sensex-nse-nifty-india-stock-markets-asian-paints-coal-tragedy-jharkhand-coal-mines.jpg?h=450&l=50&t=40)

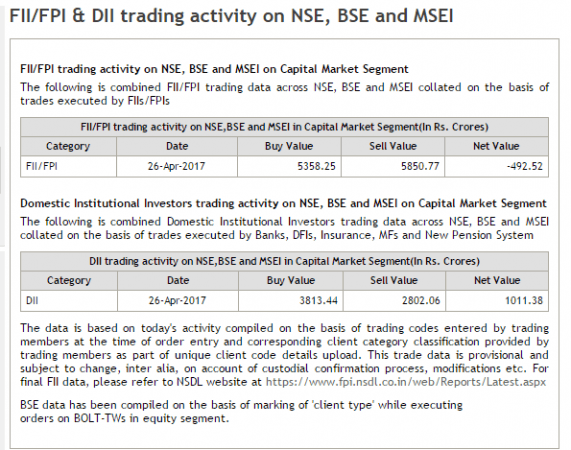

Indian stock markets were on a roll on Wednesday, April 26, with benchmark indices Sensex and Nifty closing at record highs, tracking global and domestic cues. But foreign institutional investors (FIIs/FPIs) turned contrarian, apparently preferring to book profit and ended up as net sellers to the tune of Rs 492.52 crore. Domestic institutional investors (DIIs), on the other hand, were net buyers of stocks worth Rs 1,011.38 crore.

The BSE Sensex closed 190 points higher at 30,133, a record closing for the benchmark after it hit an all-time high of 30,167 while the 50-scrip NSE Nifty ended 45 points higher at 9,352.

Top index gainers were ITC, M&M and HDFC while Ceat, SKF India, Andhra Bank, Tata Chemicals, BEML, MRF and Marico hit a new 52-week high during the day.

Analysts say the rally from here on will depend on earnings and inflows by institutional buyers. "We continue to remain positive on the market. Further upside will be dependent on earnings season and liquidity flow," Harsha Upadhyaya, CIO (Equity), Kotak Mutual Fund, said in a note.

Positive domestic cues are likely to lend momentum to the rally, acording to Angel Broking. "Overall, the market are likely to remain strong with GST implementation just a couple of months away and expectation of normal monsoon this year," Vaibhav Agrawal, head of research at the brokerage, said in his note.

"Today's rally was sparked by the outcome of Delhi MCD election and victory of favourable candidate in first round of French elections," he added.

Cues from the US could also lend support to the rally on Indian stock markets, with President Donald Trump expected to slash corporate tax rates on Wednesday.

Shares of Allcargo Logistics ended 6 percent higher at Rs 190 apiece on the back of a block deal.

The Indian rupee hit a 20-month high of 63.93 to the US Dollar on Wednesday before closing at 64.12.

Gold prices fell Rs 250 to close at Rs 29,350 per 10 gm on the eve of gold-buying festival Akshaya Tritiya on Friday, April 28, though an increase is foreseen. "The broad spectrum is bullish for Gold; with the safe heaven appeal and attractive asset to accumulate on the precious day of Akshaya Tritiya for long term. Gold is expected to hover in the upper trajectory of Rs 30,000 mark in the domestic market," Aurobinda Prasad Gayan, VP Research at Kotak Commodities, said in a note.