The flipside of crypto-currency is emerging again with the crash of a host of the virtually "mined" currencies over the weekend. This may not be an identifiable bubble signal right now, though realisation is dawning in the market that it is not just about the bitcoin alone – the crypto-currency market is collectively capitalised at $65.64 billion at the time of going to print. Bitcoin brings up almost half this combined market cap of all crypto-currencies.

The bitcoin virtual currency which was at its peak in 2015 and 2016, providing a windfall to early investors, is again under siege. And, yes, it will be shortlived as always as supply adjusts to demand. The combined market cap of crypto-currency increased by over $3 billion in the span of a few hours on Sunday, indicating high market volatility. But this time round, the investor scare comes with a lot more questions attached.

Bitcoin, and other blockchain-based alt.coins (or alternative digital coins) like Ethereum or Ether and Monero are feeling the pressures of uncertainty over the markets, and reacting to the resulting speculation. Much of the speculation is short-term and fuelled by concerns over the crypto-currency market, which has undergone a period of rapid appreciation since the beginning of 2017.

Bitcoin surged another 150 per cent this year to top $3,000 in June, but has since fallen back more than 20 per cent to around $2,327 on the back of selling pressure. On Saturday, the price of bitcoin hit a 49-day low, falling below $2,000 for the first time in weeks amid a broad selloff across crypto assets.

Coindesk.com had in a report late on Saturday, said that the overall figures observed for both bitcoin and the total crypto-currency market were the lowest since late May. Further, the asset class was down 11 percent over a 24-hour span at publication, a time during which it shed roughly $9 billion in value, Coindesk said.

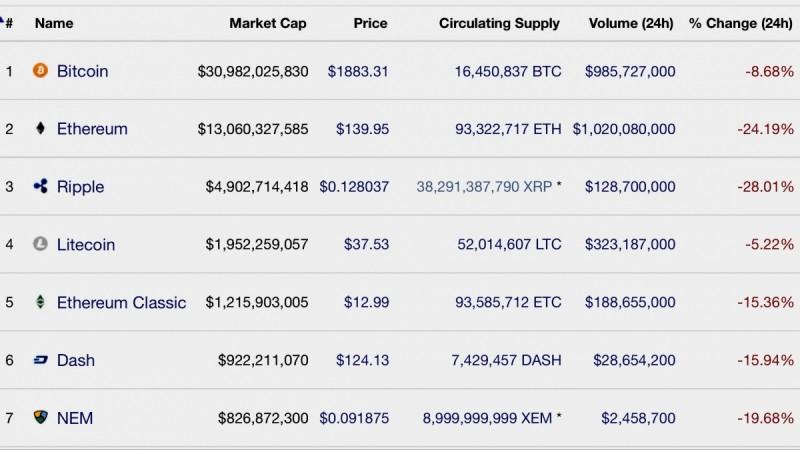

Crypto-currency market capitalisation

Fuelled up on Ether

The market for Ether has come under sell pressure, spurred by the entry of numerous Initial Coin Offerings (ICOs) on the market. Scores of ICOs, -- what Jamie Burke, the founder and CEO of blockchain-focussed VC firm Outlier Ventures, calls "the blockchain ecosystem's killer app" --, have been launched in 2017. Virtually all these ICOs, mostly early crypto-currency projects far from generating significant revenues, are being fuelled by Ethereum and its clients such as Metamask, Parity, Mist and MyEtherWallet.

As of May 2017, companies raised $180 million in ICOs, compared to $101 million in all of 2016, according to Smith + Crown, a blockchain research, data and consulting group. This has lured even more money into crypto-currencies.

Incredibly high spikes and deep troughs in trading patterns of crypto-currency has caused trepidation among investors and companies who use crypto-currency mining software to acquire virtual currencies like Bitcoin, Ethereum, Litecoin, Zcash, Dash (originally Dark Coin), Tether, Monero and Ripple.

Bitcoin continues to lead the pack of crypto-currencies, in terms of market capitalization, user base and popularity. Nevertheless, virtual currencies such as Ethereum and Ripple which are being used more for enterprise solutions are becoming popular, while some alternatives are being endorsed for superior or advanced features vis-à-vis Bitcoins.

Bitcoin is essentially a mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with them. Central to Bitcoin is a public ledger, known as the Block Chain. Roughly every 10 minutes, a new "block" is added to this chain or ledger. This ledger records all of the transaction that have taken place in the last 10 minutes, and what quantities of bitcoin currency are now held at different public addresses.

Bitcoins are created and entered into circulation through a process called "mining". Bitcoin miners download free software that they use to solve complex math problems. Solving these problems verifies the validity of bitcoin transactions by grouping several transactions into a block and mathematically proving that the transactions occurred and did not involve double spending of a bitcoin.

Not just digital cash

Since bitcoins and other crypto-currency are mined and not minted, central banks have found the part of regulating it rather problematic. Understandably, different countries have taken varied approaches to regulation and oversight. The United States has led the way, though different agencies like the Securities Exchange Commission and the US Internal Revenue Service treat cyptocurrency in different ways.

The US Federal Trade Commission applies the Federal Trade Commission Act to combat unfair or deceptive acts or practices in or affecting commerce, which includes virtual currencies. In addition, approximately 44 states in the US have issued licenses to companies that use virtual currency in their business model.

Wider regulatory coverage of crypto-currency, particularly Bitcoin transactions in the US market have led to greater flexibility in trade and monetisation via online exchanges. For the Federal Reserve, this has raised the responsibility levels needed to look at financial innovation across a broad range of functions, including payments and market infrastructures, supervision and financial stability.

The fact that a decentralised means of tracking and assigning wealth or economic value through a software protocol, computer network, idea, community or open source movement is not anathema just because of it being beyond official and bureaucratic bounds or oversight. The official feet-dragging on crypto-currency is also because it becomes difficult for monetary institutions to fix damages or pin accountability in the event of fraud or a market crash involving virtual currency trading.

The Indian government and banking regulator Reserve Bank of India (RBI) bring their own set of reservations into the crypto-currency debate. A government-appointed panel is still undecided on how to formulate regulations around it and which body will hold responsibility for regulatory oversight, though the government has not made negative noises about declaring transactions illegal in India.

An exclusive story from Moneycontrol.com suggests that the Bitcoin will most likely fall under the RBI's ambit. Moneycontrol quotes a banking official as saying that there have been other opinions about the Bitcoin being a security rather than a currency, and such an instrument should be regulated by Sebi (Securities and Exchanges Board of India).

Bitcoin and the 'alts'

The extant rule on Bitcoin generation limit capped at 21 million has not factored in market spikes and largescale shortages caused by the emerging ICO trend of fundraising by corporates. Counter-intuitively, bitcoin's biggest weakness -- the system's limited capacity -- has also increased demand for crypto-currencies.

1/7 3 reckless ICOs in the system now: @BancorNetwork @TezosFoundation @EOS_io. They are experiments, not by any stretch of imagination.

— William Mougayar (@wmougayar) July 14, 2017

Near fraudulent ICO's are bound to occur and will taint the promise of serious, meaningful #Blockchain applications

— Bhagwan Chowdhry (@bhagwanUCLA) May 25, 2017

Bitcoin's developers have argued for years about how to expand the system, which can only handle seven transactions per second, compared with thousands on conventional payment services. Even before the argument was fructified, new crypto-currency options (or "alt.coins") have emerged in recent years.

Blockchain currently claims to process 160,000 transactions a day across 140 countries. The ultimate vision is to make all crypto-currency data and transactions trackable via an electronic ledger that eliminates delays caused by disparate currencies and financial systems.

It will take more time to come up with rules around crypto-currency, even as new challengers have emerged to the Bitcoin in recent years. Ethereum looked the most credible of the lot as it was not just another blockchain technology, but explored new applications for crypto-currency.

A study by the John Hopkins Carey Business School in October last year, notes that primary demand in the future for crypto-currencies such as Bitcoin and Ether will stem from their utility as alternative payment channels and as digital assets. "Both Bitcoin and Ether have great potential in penetrating the retail market as they provide a more convenient and affordable solution for both domestic and cross-border transactions," the study says.

Trending on popularity alone, crypto-currencies look set to stay on, but who among them will emerge leaders amid the growing competition within the space will only be revealed with time. As yet, many central banks are in wait-and-watch mode on the utility of crypto-currency.

For now, the burning question on every bitcoin aficionado's mind will be when the market will turn. Equally pertinent is the ongoing debate on ICOs, which are completely unregulated and how long they should stay that way. What if a company issuing an ICO absconds with the money? What is the level of oversight which ICOs need, and can unsafe ICOs be controlled without prices falling steeply? Answers to these should illuminate a small part of the road ahead for crypto-currency.