The decision to waive Maharashtra farmers loans will set the state government back by at least Rs 30,000-Rs 32,000 crore, said a report in the Hindustan Times newspaper on Tuesday.

"While the government has managed to end the farmer protests, it has indicated that balancing the burden of unpaid loans, given the state's poor finances, is not going to be easy," the report said.

The government is looking to apply a cap on the benefit of the waiver up to Rs 75,000 to Rs 80,000 in a bid to minimise the burden to Rs 30,000 crore or below, it has said. A liability of over Rs 25,000 crore is likely to fall on the state government if the loan waiver is implemented, senior officials had indicated earlier.

With the fresh loan waiver, total farm loans across Maharashtra stand at Rs 1.1 lakh crore. The state is already under estimated debt of Rs 4.13 lakh crore, and a loan waiver could lead to 20-25 percent cuts in funding for ongoing projects such as metro, road will see cuts in funding.

According to HT, a group of senior ministers discussing the loan waiver with the farmers, is also looking to rope in banks to stagger the loan amounts over the next five years so that the yearly burden is reduced to Rs 6,000 crore.

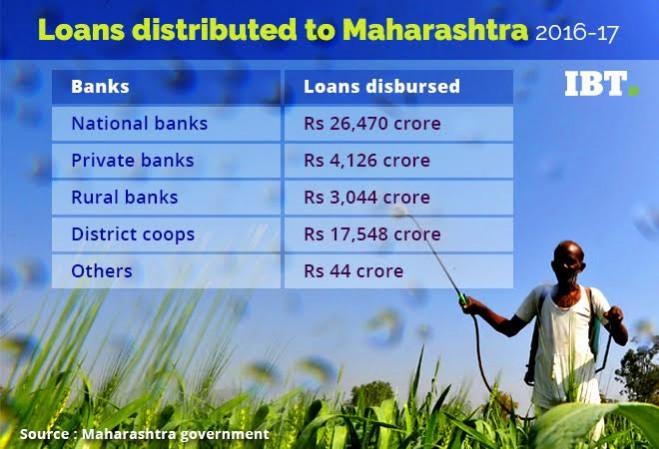

During 2016-17, the total allocation of crop loans was Rs 51,235 crore, which benefited 52 lakh farmers across Maharashtra.

Maharashtra Finance Minister Sudhir Mungantiwar, had in his Budget speech three months ago, said that while he is aware of the deep indebtedness of farmers in the state, a loan waiver would be an ill-advised step as it would have an impact on investment in the agriculture sector and would provide no assurance that the farmer would permanently come out of the debt trap.

According to available, data, compared to 2014, crop loans disbursed in 2016 show an enhanced allocation of Rs 7,942 crore, benefiting an additional 7.66 lakh farmers.

The seventh Pay Commission has already increased the burden on the government, and The Hindu had reported earlier that the Maharashtra government is likely to delay implementation of the Seventh Pay Commission recommendations if the loan waiver harmed its finances.

A group of senior ministers discussing the loan waiver with farmers, is also looking to rope in banks to stagger the loan amounts over the next five years so that the yearly burden is reduced to Rs 6,000 crore.

A senior minister, member of the group, told HT that the government will give banks the guarantee in the form of bonds with future validity. Many private and nationalised banks seem open to this idea, he said.

By staggering the loan amount, the state will also be able to keep its financial parameters from going haywire. With the burden of farm loan waivers, the state's overall debt is likely to balloon from an estimated Rs 4.13 lakh crore to Rs 4.40 lakh crore and its fiscal deficit is set to increase from the current estimate of 1.53 percent of Gross Domestic Product (GDP).