Sparking a nationwide outrage on social media, veteran Congress leader Jairam Ramesh claimed that the government has increased Goods and Services Tax (GST) on crematorium services to 18 percent. Following Ramesh's tweet, many users reacted strongly in retrospect to the mass cremations that took place during peak COVID. But as it appears, the claim is misleading and factually incorrect.

The claim

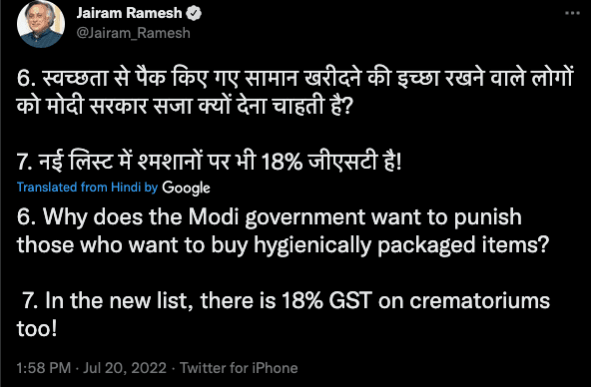

Jairam Ramesh, Congress General Secretary, denounced Finance Minister Nirmala Sitharaman for defending the hike in GST rates. Among other things like GST hike on pre-packaged and labelled goods, the minister claimed that the GST on crematoriums had been increased to 18 percent.

"The Modi government is penalising aspiration and a desire to buy more hygienically packed goods go through the list. The GST on crematoriums has been increased to 18%!" Ramesh claimed.

6. स्वच्छता से पैक किए गए सामान खरीदने की इच्छा रखने वाले लोगों को मोदी सरकार सजा क्यों देना चाहती है?

— Jairam Ramesh (@Jairam_Ramesh) July 20, 2022

7. नई लिस्ट में श्मशानों पर भी 18% जीएसटी है!

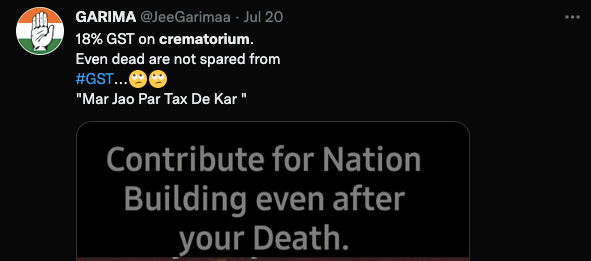

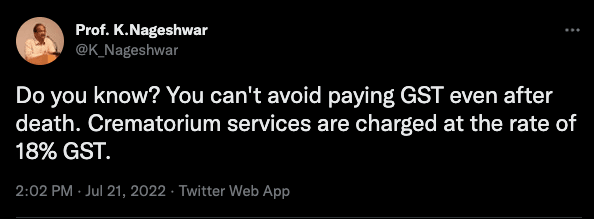

As a result of this claim, many users took to social media to vent out their anger. Many criticised the government for "penalising" crematorium services.

Fact check

International Business Times reviewed the claims made by the Congress leader and verified them against the information available on the GST website. There is no information related to 18 percent GST levied on crematoriums.

Upon further research, it was found in The Central Goods and Services Tax Act, 2017, that "services of funeral, burial, crematorium or mortuary including transportation of the deceased" is classified as "activities or transactions which shall be treated neither as a supply of goods nor a supply of services." In simpler terms, no GST applies to crematoriums and funeral-related services.

The wheel of misinformation appears to spin based on a reference to GST applicable on work contracts. To elaborate, contract services supplied by way of construction, erection, commissioning, and installation, completion, fitting out, repair, maintenance, renovation, or alteration of a structure meant for funeral, burial or cremation of deceased are classified as work contract services, hence not exempted from GST. This is mentioned in Section 2(119) of the CGST Act, 2017.

Previously, construction work of funeral grounds and crematoria was levied 12 percent GST. It is now 18 percent. PIB Fact Check has also debunked the claims of 18 percent GST on crematorium services and issued a similar clarification.

After reviewing these facts, IBTimes has arrived at the conclusion that the claim about GST on funeral, burial, crematorium or mortuary services is false. The 18 percent GST is applicable only on work contracts and not the services.