Soon after the J&K administration issued a notification regarding imposition of property tax in the Union Territory, calls of resistance from the opposition leaders started pouring in. Despite J&K getting the lowest tax rates as compared to any other state in the country, opposing parties refused to come to terms with the new order.

Property tax will be imposed in Jammu and Kashmir from April 1, 2023, as per the notification issued on Tuesday. J&K was the only state/UT in the country to be exempted from property taxes, until now. As per the notification, the administration has proposed Property Tax on all properties – residential or non-residential at rates of 5% and 6% respectively annually of Taxable Annual Value (TAV).

But the new order hasn't gone down well with the local leaders in the UT. From National Conference leaders to Srinagar Mayor and Dy Mayor, leaders have rejected the proposal and are looking for ways to contest the order.

The claim

The Jammu and Kashmir National Conference (NC) on Tuesday decried the notification regarding imposition of property tax in the Union Territory, claiming that it smacks of arbitrariness.

Responding to the notification, NC spokesperson Imran Nabi Dar said, "The people of Jammu and Kashmir have been at the receiving end economically since 2019 due to the losses suffered by the August 5, 2019 lockdown and then the successive Covid lockdowns. Imposition of property tax will further push the people to the wall. Such decisions will make the situation worse."

Dar termed the decision as 'anti-people' and a 'grave injustice', as he demanded its immediate rollback.

Similarly, Mayor of Srinagar, Junaid Azim Mattu slammed the J&K administration for the imposition of Property Tax in J&K, terming it "ironically violative of municipal empowerment."

"Imposition of Property Tax in J&K is ironically violative of municipal empowerment as this has neither been deliberated upon, nor approved by elected ULBs. While SMC will explore ways to contest this arbitrary move, I am writing to the Hon'ble LG seeking a withdrawal of the SO," Mattu tweeted.

![Junaid Azim Mattu tweet Fact check: J&K property tax not arbitrary; follows municipal act [read facts]](https://data1.ibtimes.co.in/en/full/782312/fact-check-jk-property-tax-not-arbitrary-follows-municipal-act-read-facts.png?w=587&h=217&l=50&t=40)

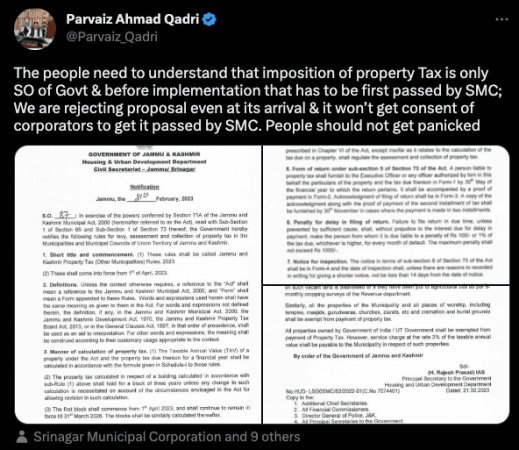

Deputy Mayor of Srinagar, Parvaiz Ahmad Qadri echoed Mattu's views and said that the proposal won't get consent of corporators to get it passed by SMC.

"The people need to understand that imposition of property Tax is only SO of Govt & before implementation that has to be first passed by SMC; We are rejecting proposal even at its arrival & it won't get consent of corporators to get it passed by SMC. People should not get panicked," he tweeted.

"No taxation without representation. Why should people in J&K pay state taxes, including the proposed property tax, when we have no say in how our government is run and no say in decision-making of J&K? We are expected to be mute spectators to all unjust decisions by Raj Bhavan," tweeted former chief minister and National Conference vice-president Omar Abdullah.

Fact check

International Business Times reviewed the claims made by political leaders in J&K regarding the property tax notification. While many called the move arbitrary and that it won't get passed, the UT administration's decision is not without due diligence. In fact, the Municipal Act of 2000 clearly outlines the power of government with respect to taxation.

![Fact check: J&K property tax not arbitrary; follows municipal act [read facts] Fact check: J&K property tax not arbitrary; follows municipal act [read facts]](https://data1.ibtimes.co.in/en/full/782311/fact-check-jk-property-tax-not-arbitrary-follows-municipal-act-read-facts.png?h=450&l=50&t=40)

If you look at section 71 and 71A of the J&K Municipal Act 2000, the government is well within the legal course to impose taxation laws and the urban bodies must abide. Read the detailed sections below, particularly the section 71 sub-section 3 of the Municipality Act 2000.

71. Power of Government in respect of taxation. ––(1) The Government may, by special or general order notified in the *[Government Gazette], require a municipality to impose any [fee], mentioned in section 66 not already imposed, at such rate and within such period as may be specified in the notification and the municipality shall thereupon act accordingly.

(2) The Government may require a municipality to modify the rate of any [fee] already imposed and thereupon the municipality shall modify the [fee] as required within such period as the Government may direct.

(3) If the municipality fails to carry out any order passed under sub-section (1) or sub-section (2), the Government may, by a suitable order notified in the Official Gazette, impose or modify the [fee]. The order so passed shall operate as if it were a resolution duly passed by the municipality and as if the proposal was sanctioned in accordance with the procedure contained in section 70.

5[71A. Powers of Government to make interim arrangements with regard to assessment and collection of taxes and fees. ––(1) The Government may, by notification, make such interim arrangements for the assessment and collection of one or more of the taxes and fees levied in terms of any of the provisions of this Chapter as may be deemed necessary or expedient, and the provisions of this Chapter in so far as they relate to the assessment and collection of any such tax or fee shall stand modified to the extent and in the manner given in the notification during the period such interim arrangements remain in force.

Hence, reviewing the municipal laws, it becomes clear that the J&K property tax notification is not arbitrary, illegal, or unconstitutional. IBTimes has arrived at the conclusion that those opposing the order have no legal standing.