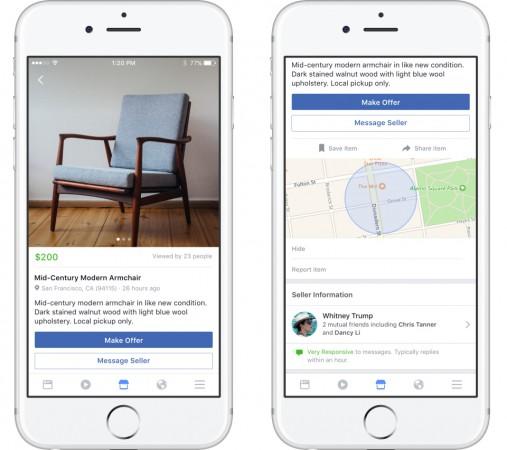

After Facebook introduced Marketplace within the social network, its users were treated with an easy and social way of selling pretty much anything online. There are listings for properties, used bikes, cars, house rentals, clothes, furniture and much more, serving users a one-stop-shop for your social networking as well as shopping needs.

While there are many pros to the Facebook Marketplace, it has also opened a new avenue for scammers to trick people. With more than 2 billion users around the world, Facebook is the ultimate target for scammers to carry out frauds online. The Marketplace has made it a lot easier for scammers to trick people and make quick cash.

Facebook Marketplace - A hunting ground for scammers

If you've ever used Facebook Marketplace, you'd know how simple it is to post an ad and sell your item without any hassles. The ease of communicating online and exchanging payments digitally eliminates the need for the seller and buyer to meet in person. But that convenience comes at a cost - quite a hefty one if you don't see the signs.

According to a report by Gadgets Now, a Thane resident was duped twice by the same conman on Facebook. It all started with an ad to sell furniture online. The scammer, posing as a buyer, contacted the seller and agreed to buy the furniture at the advertised price. But the scammer offered to pay via mobile wallet, and things got tricky from thereon.

In order to make payments via mobile wallet, both parties need to agree to the transaction. While the payer goes through OTP verification as an added security step before making a payment, the payee simply accepts the incoming payment without OTP.

The scammer, instead of making the payment, requested for money on Paytm, which sent an OTP to the seller. The victim thought he was receiving money so he gave away the OTP and money got debited from his account. The scam didn't end there.

The victim confronted the scammer about the deducted money via Paytm, to which the scammer apologised and offered to refund it via Google Pay. But he requested payment again on Google pay and the victim lost his money again. A total of Rs 1.01 lakh was lost to the scammer in a matter of minutes.

Thumb rule for mobile wallet transactions

Anyone who uses any mobile wallet must know that OTPs are only sent to the payer. The payee never gets an OTP to receive any payment. It is also worth noting that OTPs must never be shared with anyone under any circumstances. With simple negligence, you could lose your hard-earned money to these scammers.