Driven by the dream of India's Digital Sarvodaya – meaning India's Inclusive Digital Rise to improve the quality of life of every single Indian and to propel India's growth story as the world's leading digital society, Reliance Jio and Facebook have entered into a partnership, with the social media giant acquiring 9.99% stake in Jio platforms for Rs 43,574 crore.

The investment of Rs 43,574 crore by Facebook values Jio Platforms at Rs 4.62 lakh crore pre-money enterprise value ($65.95 billion, assuming a conversion rate of Rs 70 to a US Dollar). Facebook's investment will translate into a 9.99% equity stake in Jio Platforms on a fully diluted basis.

The Reliance Jio-Facebook deal is focused on meeting the needs of India's 60 million micro, small and medium businesses, 120 million farmers, 30 million small merchants, and millions of SMEs in the informal sector while empowering people seeking various digital services.

Competing with the likes of Google Pay and Paytm for a market that will be worth $135.2 billion in 2023, according to an Assocham-PWC India study, Mark Zuckerberg chose to invest in Jio for a minority stake only after the Indian government gave a positive nod for Whatsapp digital payment services recently.

Now, what does this deal mean for India Inc?

For long, Zuckerberg was focused on rolling out a digital payment service on Whatsapp, on the lines of Google Pay and Paytm wherein purchase and sale of products can be made possible on the social network's mobile messaging platform in India.

However, due to data privacy and content regulation concerns on the app being raised, the regulators in India have not been welcoming towards Facebook to launch its Whatsapp digital payment service in India called Free Basics in 2015. Now with this newly pledged alliance with Jio, Facebook looks at a positive possibility to be able to launch Whatsapp digital payment services soon to facilitate local vendors and Kirana stores from using the service for customer orders.

Separately, Facebook is also looking at India as a potential market for the launch of its cryptocurrency project Libra. "Payments and commerce are a priority, representing a major business opportunity for the company moving forward," Zuckerberg said. For the Reliance Group that has been battling the impact of COVID-19 crisis and slump in demand for crude oil, this alliance brings hope and positivity in these trying times.

The press release stated, "In the post-COVID-19 era, comprehensive digitalisation will be an absolute necessity for the revitalisation of the Indian economy. It is our common belief and commitment that no Indian should be deprived of the tremendous new opportunities, including opportunities for new employment and new businesses, in the process of India's 360-degree digital transformation."

"Jio's deal with Facebook is good not just for the two of them. Coming as it does during the virus-crisis, it is a strong signal of India's economic importance post the crisis. It strengthens hypotheses that the world will pivot to India as a new growth epicentre. Bravo Mukesh!", Anand Mahindra, Chairman, Mahindra Group tweets.

Could this deal be a game-changer for India's digital market?

Jio's vision is to enable a Digital India for 1.3 billion Indians and Indian businesses, especially small merchants, micro-businesses and farmers. Jio has brought transformational changes in the Indian digital services space and propelled India on the path towards becoming a global technology leader and among the leading digital economies in the world, according to the press release.

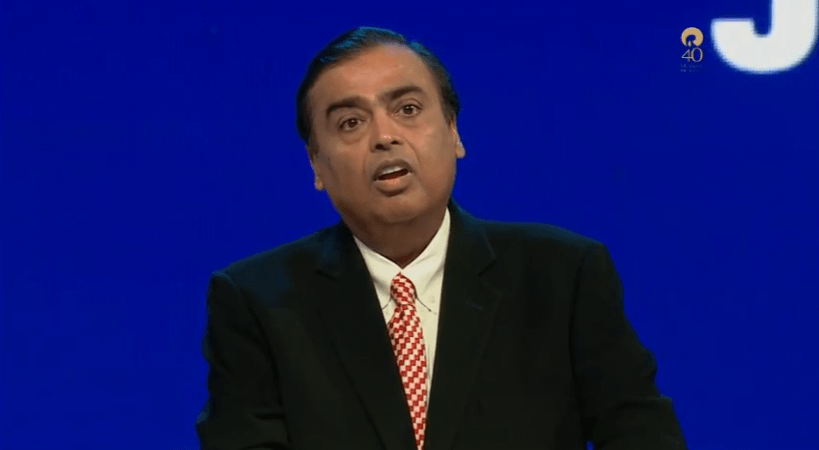

"At the core of our partnership is the commitment that Mark Zuckerberg, founder of Facebook, and I share for the all-round digital transformation of India and for serving all Indians. Together, our two companies will accelerate India's digital economy to empower you to enable you and to enrich you. Our partnership will be a great catalyst to make India the world's leading digital society," says Reliance Industries Limited, Chairman, Mukesh Ambani in his speech.

With this deal, Ambani is looking at building an e-commerce business JioMart by roping in leading global partners and launching IPOs, to rival against Amazon and Walmart e-commerce in South Asia. The tie-up will empower nearly 3 crore mom-and-pop store owners in your area to enable taking digital payments from customers in their neighbourhoods and help customers source immediate delivery of items from the nearby local Kirana stores by transacting seamlessly with JioMart using WhatsApp. As part of the deal, local vendors and small Kirana stores can register on JioMart and receive grocery and daily essential orders from customers using WhatsApp.

Together Reliance Retail Ltd, WhatsApp and Reliance Jio will work towards accelerating the e-commerce push on the JioMart platform, Reliance Industries said in a statement. "The intent behind this partnership is not to build another app, but to collaborate better," says Ajit Mohan, vice president and managing director for India at Facebook.

In a nutshell

"The collaboration with Facebook will give Jio a significant advantage on product and technological fronts to keep competitors miles away and grab a larger wallet share of consumers across domains -- telecom, payments, retail," Himanshu Shah, an analyst at Dolat Capital Market Pvt. wrote in a research note.

Having a local partner for Facebook could help the social media giant navigate regulatory hurdles successfully, including privacy-related concerns, data storage and other threats.

"And in the days to come, this winning recipe will serve other key stakeholders of Indian society. Our farmers, our small and medium enterprises, our students and teachers, our healthcare providers and above our women and youth who formed the foundation of a new India," Ambani added in his news statement.

The share price of Reliance (RIL) rallied over 11 per cent today, while the company scrips advanced by 11.37 per cent to Rs 1,376.60 on S&P BSE Sensex and on the NSE Nifty50, the company surged 11.17 per cent to Rs 1,376.30, post announcement of the deal with Facebook. This deal led to an increase in RIL's market valuation by Rs 45,527.62 crore to Rs 8,29,084.62 crore. To cut debts, RIL has been eyeing strategic partnerships across its businesses in the recent past, an attempt to deleverage its balance sheet.