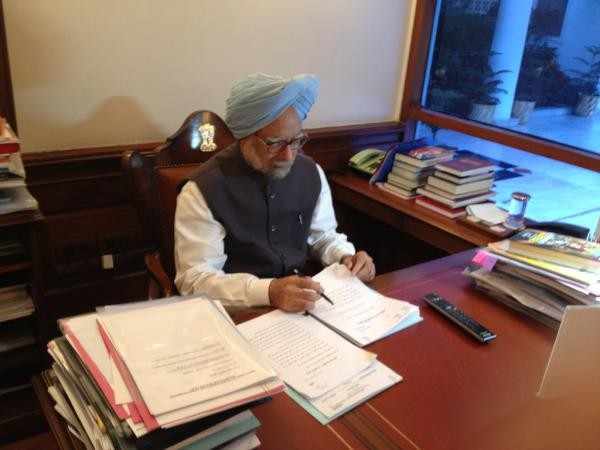

An advisory panel on General Anti Avoidance Rules (GAAR) set up Prime Minister Manmohan Singh recommended the postponement of the controversial prevention of tax evasion rule to be put off until 2016-17, in a move that will ease foreign investor worries about investing in India.

On Saturday, the expert committee headed by tax expert Parthasarathi Shome submitted a report to the Finance Ministry, proposing the exemption of tax for at least three years on investments routed through Mauritius, which has a special tax treaty with India.

The panel also recommended to the Ministry to apply the exemption to non-resident tax payers instead of only Foreign Institutional Investors.

"GAAR is an extremely advanced instrument of tax administration - one of deterrence, rather than for revenue generation - for which intensive training of tax officers who would specialize in the finer aspects of international taxation is needed," the panel explained according to The Times of India.

Introduced in the budget in March, GAAR dissuades tax avoidance by companies who route their investments through tax havens. Fearing its misuse, investor confidence weakened, thus leading to a slump in the economy. To address these concerns Manmohan Singh set up the Shome panel and halted the implementation of the retro taxing provision in GAAR till April 2013.

The panel said that an assessment of GAAR for 2016-17 will soon be announced, this being a common practice. "It would be perspicacious, as indicated above, for the government to postpone the implementation of GAAR for three years with an immediate pre-announcement of the date to remove any uncertainty from the minds of stakeholders," it said.

Considering the economy's deepest slump in nine years, Finance minister P Chidambaram on Tuesday promised a change in tax laws and is urging officials not to hound taxpayers. The tax revenue target for 2012-13 is currently ![]() 5.05 trillion, which the finance minster said is possible for the government to achieve.

5.05 trillion, which the finance minster said is possible for the government to achieve.