A deceleration of global annual growth below 2.5 per cent is often considered to be the recessionary threshold for the global economy. It is important for policymakers to look at effective steps to mitigate the damage caused by the coronavirus outbreak to the physical and economic health of people, and overall well being.

If the effects of the outbreak are short-lived, then accommodative monetary policies to include cuts in the central bank's rate and lower long-term interest rates can be implemented. However, if the effects of the pandemic are long-lasting then, there will be disruptions on the supply side witnessed through crippled production networks and squeezed profit margins. Hopes of economic recovery rests on active fiscal policies, sustained and coordinated liquidity inflows by Central banks, and focused efforts to bolster free trade and foreign investment.

Impact of coronavirus outbreak on economy

The outbreak and spread of coronavirus have exerted downward pressure on the FDI between -5% to -15%. With heightened economic anxiety and sluggish growth prospects, the rapid spread of the virus has brought about a combination of wage suppression, wealth concentration, rise in inequality across most countries, and corporate rentierism.

Also misallocation of capital and resources to low-productivity sectors such as real estate and personal services in the rising "gig economy" has been observed. In H2 2019, before the Covid-19 outbreak, it became increasingly clear that the global economy had entered troubled waters with slower growth witnessed across all regions and contraction observed in economies in the final quarter.

The economic uncertainty will likely cost the global economy $1 trillion in 2020. The spread of the virus will potentially damage and affect three main channels of disruption: demand, supply and finance.

On the demand side, the economy will see shifting sentiments owing to the fear of contagion and absence of vaccine to impact private spending. There will be possible layoffs, reduced working hours, declining income levels, and need for emergency-health initiatives in some countries will increase.

On the supply side, manufacturing activity in affected regions will see a sudden stop to result in bottlenecks in global value chains across China, the Republic of Korea and Japan, as well as South-East Asian economies. While inventory decumulation can support for a brief time period, in today's demand-based just-in-time production structures, the inventory stocks are almost on the verge of exhaustion. This disruption has triggered widespread factory closures even in countries that are still immune to the virus, because of the lack of intermediary inputs.

Dented profit margins, huge losses

Profits have faced a major hit, there has been a steep decline in employment and wages owing to coronavirus scare. Also, exports of both manufactured final goods and of commodity inputs have weakened sharply to affect earnings and employment globally.

Hardest hit industries by Covid-19 outbreak are the automotive industry (-44%), airlines (-42%) and energy and basic materials industries (-13%). The outbreak of Covid-19 has slowed down capital expenditures of MNEs and their foreign affiliates. Certain production facilities are closed down or are continuing to operate at lower capacity, will halt new investments into physical assets temporarily and delay expansion plans.

Ongoing greenfield investment projects are already delayed. Mergers and acquisitions have also slowed down. According to UNCTAD's data for February, a significant drop in the completion rate of cross-border acquisitions below $10 billion from normal monthly values of $40-50 billion has been observed.

The International Monetary Fund (IMF) is willing to provide $50 billion in grants to mitigate the effects of the coronavirus crisis to the most vulnerable countries, and zero interest loans to the immune others.

What should policymakers do to avert the crisis?

With global policymakers in a damage control mode, Gita Gopinath, chief economist of the International Monetary Fund (IMF) has urged policymakers to implement "substantial targeted monetary, and financial market measures" to help affected households and businesses overcome the crisis.

This can be achieved by providing assistance to businesses in the form of cash transfers, tax relief and wage subsidies. Also, the government would offer temporary and targeted credit guarantee to meet the immediate liquidity needs of these firms.

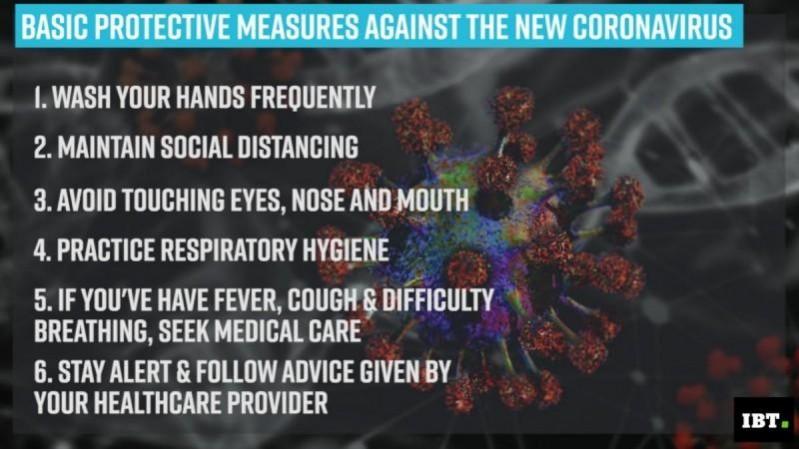

In these times, it is important for countries to boost their healthcare spending and health systems. The report suggests that, "Central banks should do "whatever it takes" in the face of the Covid-19 including directing credit for production and employment creation(rather than financial speculation or bailouts), reinforcing public infrastructure and development banks, providing tailored credit lines for financially distressed SMEs. At the international level, multilateral institutions like the IMF should offer concrete low-cost hedging mechanisms for governments of developing countries to manage exchange-rate risks coming from international shocks, averting the boom-bust financial cycles of recent decades and putting the global economy on a sustainable path."

There is a need to reduce reliance on value-added taxes and revert to progressive taxation mechanisms with recommendations from independent bodies such as the Commission for the Reform of International Corporate Taxation and UN Committee of Experts on International Tax Matters, which has become the need of the hour.

In conclusion

The UNCTAD report asserts, "The economic consequences linked to the virus are less a matter of time and confidence, and more a matter of the (political) leadership and (policy) coordination needed to stem the waves of economic pathogens released by the crisis from crashing into an already fragile and highly-financialised world economy. Losses of consumer and investor confidence are the most immediate signs of spreading contagion, but asset price deflation, weak aggregate demand, heightened debt distress and a worsening income distribution pose greater policy challenges."

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)