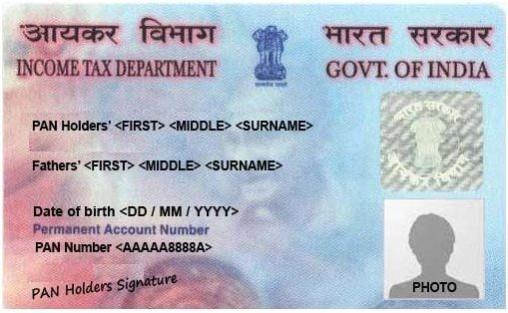

Permanent Account Number or PAN

It is a 10-digit alphanumeric number that is issued by the Department of Income Tax. It is necessary to quote PAN on all correspondence with income tax authority. It is important to take into account that having more than one PAN is against law.

How to get PAN online?

Those wanting to apply online can visit the website -- https://tin.tin.nsdl.com/pan/form49Adsc.html -- which gives guidance on how to apply for PAN and fill out the form 49A. Instructions for filling out the forms can be found here -- https://tin.tin.nsdl.com/pan/Instructions49A.html#instruct_form49A.

Once that is done, a 15-digit acknowledgement number will be generated that the applier should note down. The fee for processing the PAN application can be paid via DD/ cheque or credit card.

Offline method to get PAN

For the offline method, the procedure is no different. One has to download the PAN application form 49A and take a print and fill it as per the instructions. Once that is done, the form can be submitted along with the application fee through demand draft/cash to UTIITSL Pan service centre. The PAN card will be delivered to the mentioned address in 15 to 20 days.