PNB Housing Finance Ltd is one of India's top housing finance companies. It recently revised its interest rates of less than ₹5 Crores on FDs. After this revision, it offers interest rates ranging from 7.35% p.a. To 7.95% p.a. on deposits that mature in 12-120 months. The PNB Housing Finance FD interest rates are effective from 17th February 2023.

For deposits up to ₹1 Crore, senior citizens can enjoy an additional 0.25% p.a. interest over the base rate. They also provide you with the option of monthly, quarterly, half-yearly and annual payout, allowing you to have a steady stream of income not tied to the market. The NBFC has a AA/Stable rating by CARE and CRISIL.

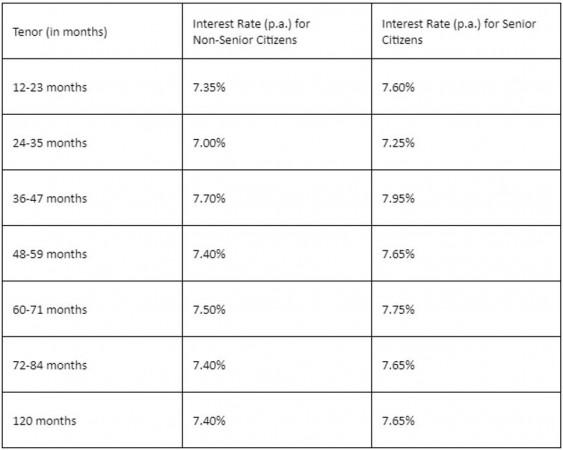

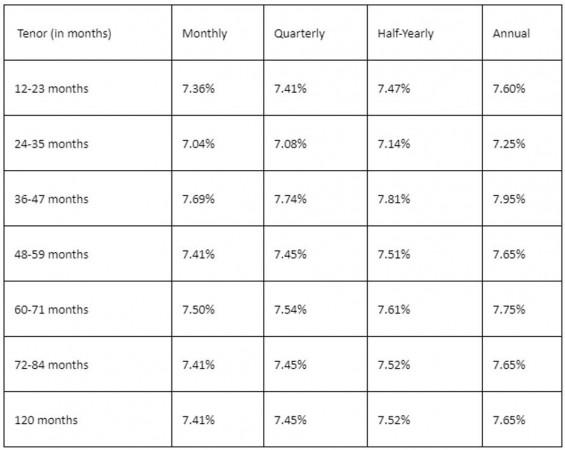

The revised interest rates of PNB Housing Finance Ltd are as follows:

PNB Housing Finance FD Interest Rates of Cumulative Fixed Deposits for General and Senior Citizens

PNB Housing Finance FD Interest Rates of Non-cumulative Fixed Deposits for General Citizens

PNB Housing Finance FD Interest Rates of Non-Cumulative Fixed Deposits for Elderly Citizens

Why Do You Need to Consider the PNB Housing FD?

PNB Housing provides reliable savings options for individuals as well as companies with the PNB Housing Finance Fixed Deposits. The benefits of the PNB Housing Finance FD are:

- Lucrative returns: They offer competitive interest rates along with a steady interest flow. You can easily start a PNB HFL fixed deposit to manage and plan your expenses. It can help you build wealth and grow your retirement corpus. You can use FD calculators available online to find the interest income.

- Guaranteed returns: The guaranteed returns you get make it one of the best savings options in the market. Market fluctuations do not influence the returns that you get. Therefore, you get assured returns on your PNB HFL fixed deposit.

- No tax deduction: No TDS is deducted if the interest income is less than ₹5,000 every financial year.

- Premature closure: Premature closure of PNB HFL fixed deposits is allowed after the three-month lock-in period. Any premature withdrawals made within six months are charged an interest rate of 4% per year.

- Flexible tenor: Individuals can open a PNB Housing FD for tenors of 12-120 months. You can pick a tenor that best suits your needs and requirements. Consider the factor of liquidity before you pick a tenor.

- Loan against fixed deposit: You can get a loan against your PNB HFL for up to 75% of the deposit amount. This will help you fund any financial difficulties.

Eligibility Criteria for PNB Housing Finance Ltd FD

The entities mentioned below are eligible to open a PNB Housing Finance Limited Fixed deposit account:

- Indian Citizen

- Sole Proprietorship

- Hindu Undivided Family (HUFs)

- Family trusts

- Companies, including group firms

- Minors under lawful/natural guardianship

- Religious and charitable trusts

- Co-operative societies

- Association of Persons

With 100+ branches spread across 35 cities in India, their vast network provides doorstep services for their FD account holders. The minimum amount for monthly income schemes of PNB Housing Ltd is ₹25,000. For all the other plans, the minimum deposit is ₹10,000. You can open a joint FD account with three joint holders maximum. The contribution for the same can be made through cheque, cheque management system. Make sure to use the FD calculator to get an idea about the returns you will get when you get started with a PNB housing fixed deposit.