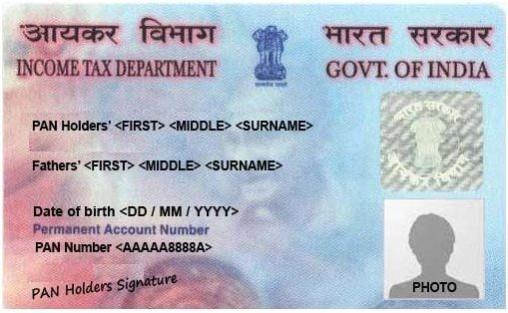

PAN (Permanent Account Number) card is an essential identifier, mostly used by the Income Tax Department. PAN card is mandatory for those who are involved in economic or financial transactions, but anyone who doesn't file income returns can apply for a PAN card. In wake of the government's efforts to digitalise India, NSDL has stepped up its efforts to make it easy for those who are seeking to get a new PAN card or simply wish to download an electronic copy of the PAN card aka e-PAN.

The NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology And Services Limited) have made it easy for Indian citizens to download e-PAN card from their official websites. The process is pretty simple and self-explanatory.

If you're an existing PAN card holder, here are 7 easy steps to download e-PAN in a matter of a few minutes.

Step 1: Go to NSDL's official website

Step 2: Enter PAN card number, Aadhaar, Date of Birth and enter the captcha before hitting submit

Step 3: Generate OTP via registered mobile number or email address

Step 4: Proceed to make a payment of Rs 8.26 towards the processing of e-PAN

Step 5: Once the payment is successfully processed, which may take up to 1 minute, you'll be redirected back to the NSDL website. You can download the receipt for your payment towards e-PAN and proceed to download e-PAN.

Step 6: Enter the acknowledgement number, which you must have received on your registered email address, complete captcha verification and then hit submit.

Step 7: You'll need to complete OTP verification once again before you can download e-PAN in PDF format. The password-protected PDF will be unlocked with your DOB in DDMMYYYY format.

It's worth noting that e-PAN card download facility is available only for one month for new PAN card, changes or correction in PAN data for free. If you have an acknowledgement number older than 30 days, you'll have to go through the steps above to download e-PAN again. We tested out NSDL's online facility for the e-PAN card and it works seamlessly.

This facility is also useful in getting a PAN copy within minutes, instead of having to wait for days. The government is considering an instant issue of PAN card in less than 10 minutes of submitting the application.

The e-PAN contains an enhanced QR code, which can be scanned using PAN QR Code Read app available for free in app stores. The e-PAN is a valid mode of issuance of PAN, according to the Central Board of Direct Taxes.