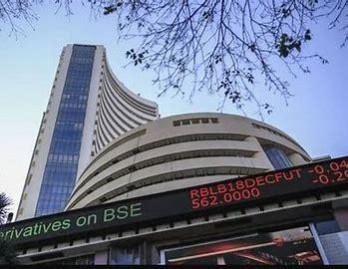

The domestic benchmark started trading in the green on Tuesday after yesterday's sluggish performance. The BSE Sensex opened at 62,300 points and currently trading close to the 62,500 mark; meanwhile, Nifty-50 opened at 18,524 and currently trading close to the 18,600 mark.

Contrary to the projections of 6.4% by various polls, India's retail inflation, measured by Consumer Price Index (CPI), dropped to 5.88%, slightly below the threshold of RBI's upper tolerance band of 6%. Since October, the inflation has been cooling off; in November, it dropped to this year's lowest level.

The better-than-expected inflation report is sentimentally positive for the market as it may pause further rate by RBI in the upcoming monetary policy meeting in February.

The data on India's factory output measured by the Index of Industrial Production (IIP) was also released yesterday by the Ministry of Statistics & Programme Implementation (MoSPI), showing a 4% contraction for October driven primarily by a contraction in manufacturing activity.

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said, "The two macroeconomic data which came yesterday have significant implications for the market. The CPI inflation for November at 5.88 % is below the RBI's upper tolerance limit. This is good news. But the bad news is that the Index of Industrial Production (IIP) shows a contraction of 4% in October. Taken together these two macro data suggest that the MPC is likely to refrain from further rate hikes.

Investors will closely follow the Fed's decision on the rate hike set to release tomorrow (14th December) and US inflation data before any risky bets. The financial market wildly speculates a 50-bps rate hike.