Calm returned to world markets on Friday after a rollercoaster week that has seen oil break $80 a barrel, government borrowing costs jump and emerging markets battered by a pumped-up dollar.

Traders were wondering if it would all flare up again with Italian politics unsettled, the United States and China locked in trade talks and Donald Trump's decision to dump the Iran nuclear deal still causing fallout.

European stocks were 0.3 percent lower, but with the euro near a 5-month low following the dollar's surge and oil shares gleeful about its rapid rise, the region was heading for an eighth straight week of gains.

Slowing Japanese core consumer price growth that kept the Bank of Japan's elusive 2 percent target well out of reach saw the dollar hit a four-month high of 111 yen though it stalled had elsewhere.

Italian government bonds continued their struggles too. They have seen their biggest sell-off in over a year this week over plans being floated by a proposed new anti-establishment coalition government.

One policy includes issuing more short-term debt to pay companies owed money by the state, the economics chief of the one of the coalition parties, the far-right League, said on Friday.

"We don't have an agreement on a government at this point, but the market remains worried," Societe Generale strategist Alvin Tan said, pointing to this week's fall in euro against the traditionally-safe Swiss franc.

The dollar index against a basket of six major currencies steadied at 93.471 having risen to a five-month peak of 93.632.

The index has gained about 1 percent this week, buoyed by the surge in U.S. Treasury yields, with the 10-year U.S. Treasury note yield scoring a seven-year peak of 3.128 percent.

Euro traders nudged the shared currency back above $1.1805, but it has fallen nearly 1.2 percent this week, largely pressured by the Italian uncertainty.

It is also heading for its fifth successive weekly drop versus the dollar, which would be a first for the shared currency since 2015.

SUBMERGING MARKETS

Elsewhere the two other macro spotlights were the hot oil markets after Brent crude broke up through $80 a barrel on Thursday, and the strain on emerging economy currencies.

The Turkish lira was holding up a bit better having fallen to a record low this week, the Brazilian real plumbed a two-year low, while Mexico's peso has shed more than 5 percent this month.

That latter continues to hit by negotiations to rework the North American Free Trade Agreement (NAFTA), which governs Mexico's trade with the United States.

"The NAFTA countries are nowhere near close to a deal," U.S. Trade Representative Robert Lighthizer said in a statement, pointing to "gaping differences" on a host of issues, including intellectual property, agricultural access, labor and energy.

A retreat by Indonesia's rupiah to a 2-1/2-year low prompted the central bank to tighten monetary policy on Thursday for the first time since 2014 to support the currency. It slipped again on Friday.

"Perhaps the most unnerving aspect of the recent rupiah weakness has been the sheer speed in which the currency markets have turned against some emerging market countries," wrote Sean Darby, chief global equity strategist at Jefferies.

"However, policy credibility is the most important tool and the fact that the Indonesian central bank has begun to tighten ought to alleviate some of the FX pressures."

In commodities, Brent crude oil futures were 16 cents higher at $79.46 a barrel after rising to $80.50 on Thursday, their highest since November 2014.

Brent has risen 3 percent this week and is headed for a sixth week of gains.

A rapid slide in oil supply from Venezuela, concern that U.S. sanctions will disrupt exports from Iran, and falling global inventories have all combined to push oil prices up nearly 20 percent in 2018.

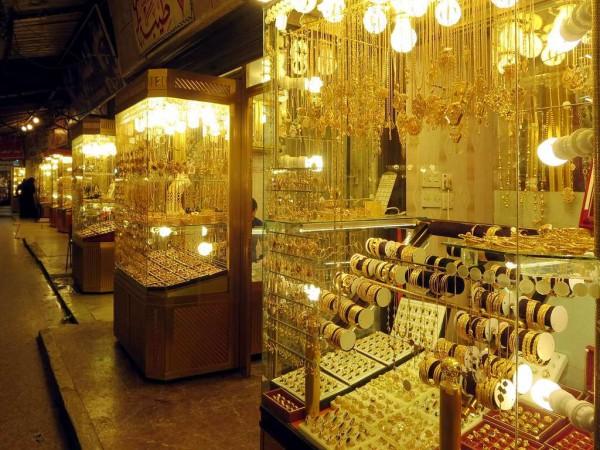

Gold meanwhile has had its worst week since early December, having dropped more than 2 percent.