The November 8 decision of Prime Minister Narendra Modi to demonetise high-value currencies could not have come at a more inopportune time for Monte Carlo Fashions Ltd. (MCFL), a company that sells winter apparel and derives about 55 percent of its revenues during the October-December quarter (Q3).

IDBI Capital Markets & Securities, after an interaction with the company's management, said in a note on Thursday that Monte Carlo's diversification into cotton wear and home furnishing should provide some cushion against its overdependence on business generated from winter wear products.

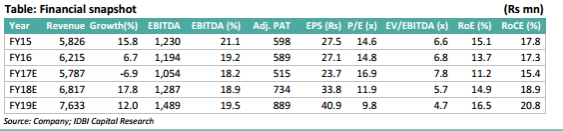

For the quarter ended September 2016, the company earned standalone net profit of Rs 13.40 crore on revenues of Rs 124 crore.

The share price of MCFL was trading at Rs 407 on Thursday at around 11.54 am on the BSE.

Here are the highlights of the analysis by IDBI Capital Markets & Securities:

MCFL is the largest winter wear brand in the $2.2 billion woollen apparel domestic market, which is largely unorganized (92 percent) with MCFL having a 2-3 percent market share.

The company has 40-50 percent of the organised market share for woollen wear (2-3 percent overall), with no specific competitor posing a significant challenge.

Factors such as GST and the recent crackdown on untaxed income are likely to facilitate market share gains for organized players within the woollen wear industry.

The company has diversified into cotton (47 percent of sales), kids clothing (five percent) and home furnishings (10 percent) — these segments include winter-themed apparel/items — to reduce dependence on the seasonal woollen wear segment.

GST could raise tax incidence from approximately five percent to 12 percent, which is a negative.

With about 55 percent of the company's sales occurring in the December quarter, FY17's financials are likely to be poor due to the demonetisation-related cash shortages currently being faced by people.

Over the long term, winter wear has limited avenues for growth, given the limited geographical market within India. However, for organized players, there remains a wide opportunity for market share gains, with more than 90 percent of the industry unorganized according to management.