In wake of the COVID-19 outbreak, MSMEs were absolutely unprepared for the pandemic threat and hence worst-hit by the financial crisis. Finance Minister Nirmala Sitharaman announced six key measures this week to help reduce financial stress and revive MSMEs. Will these measures affect the fiscal condition of banks and NBFCs?

While a moratorium of 90 days was provided by the Centre, not everybody has chosen to avail of the moratorium convenience and people are still paying. However, SBI has extended the moratorium across the board other than NBFCs, which will be done on a case-by-case basis. Considering many people are still paying back their loan dues, there is no strain on the liquidity of banks.

Banks sitting on enough liquidity, looking forward to lending

"Moratoriums and EMI relaxations will not deteriorate the bank's fiscal condition because not everybody has opted for the moratorium and there is no strain in our liquidity. We continue to be in surplus. There is no impact on the earnings of the banks," Rajnish Kumar, Chairman, State Bank of India (SBI) was quoted in a news report.

Anticipating that the six measures announced by the Finance Minister could affect the liquidity situation of banks, Kumar clarified that "Banks are sitting on enough liquidity and are looking forward to lending money to ailing enterprises."

There is a reason behind this comfortable position that banks enjoy in these times.

When 100 percent credit guarantee cover is provided by the government to the banks and the NBFCs on principal and interest, then the risk is mitigated and the capital requirement by the banks also goes down. There is thus no impact on the earnings of the bank as a result of the deferment of EMIs and interest on the working capital.

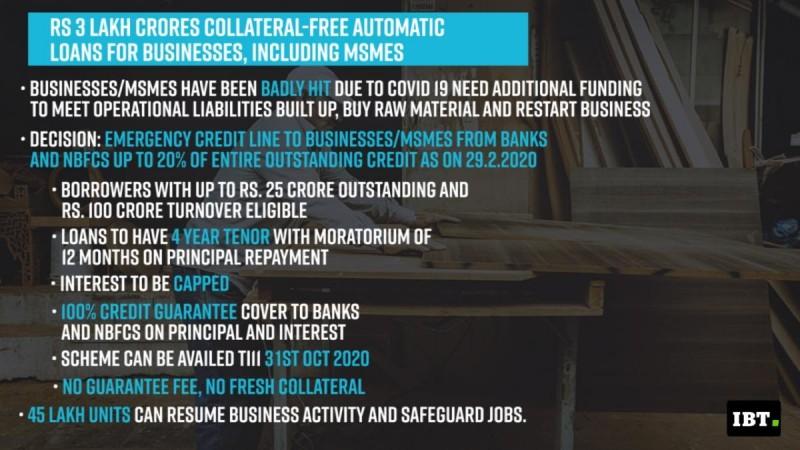

As a part of the six measures introduced this week, Rs 3 lakh crore collateral-free automatic loans for businesses to include MSMEs will be issued with four year tenor and moratorium of up to 12 months on principal repayment. Also, the interest will be capped by the Centre.

Sectors worst-hit by the COVID-19 crisis

Aviation, tourism and restaurants have been the worst affected by the Covid-19 crisis and it will take some time for these sectors to revive. Revenue of shopping malls and airports have become zero and will take some time for the revival of these because the strain of the virus is yet to be controlled.

Also, the real estate sector is worst impacted by the Covid-19 outbreak and nationwide lockdown. The problems have only got accentuated for the real estate sector, which has been under dark clouds for the past 5 years.

Role of PSBs and private sector banks in SME funding

Since the credit line for SMEs mostly fall on Public sector banks (PSBs), should private sector banks also partake in the lending process? According to Kumar, private sector banks have been equally active in SME lending in the past few years, but their approach towards lending during these current times is yet to be seen.

"PSBs are obligated for agriculture lending to a large extent, because of the reach and the responsibility of social banking which is higher on PSBs than the private-sector banks. Agriculture non-payments and NPA is more on PSBs than the private sector banks. However for priority sector lending, the obligations for both private and public sector banks are the same," Rajnish Kumar affirmed.