Flag carrier Air India has sought bids from financial institutions for lending Rs. 700 crore to the airline using a government-guaranteed short-term loan to win back its glory. The government has put up for sale its entire stake in Air India and Air India Express Ltd. as well 50 per cent shareholding in Air India SATS Airport Pvt. Ltd. The proceeds will go towards meeting its lofty disinvestment target for 2020-21.

According to sources, the fresh fund-raise of Rs 700 crore will be utilised for salary payments, in addition to meeting some debt obligations that will be maturing over the next few months. The airline has given time till March 15 to lenders to submit their bids. The memorandum for Air India's disinvestment stated that any loans taken by the airline thereafter would be transferred to the special purpose vehicle, thereby ensuring a level of certainty as far as the airline's debt situation is concerned.

Debts, pay-offs, bidding

Of the total debt of Rs 60,074 crore as on March 31, 2019, the buyer would be required to absorb Rs 23,286.5 crore, while the rest would be transferred to Air India Assets Holding Ltd., a special purpose vehicle (SPV). The SPV set up by the Union Cabinet in February 2019, as a precursor to the Air India sale will house Rs 29,464 crore debt of the national carrier and its four subsidiaries—Air India Air Transport Services Ltd., Airline Allied Services Ltd., Air India Engineering Services Ltd. and Hotel Corporation of India.

The government will repay the debt either by disposing off assets such as land and buildings held by Air India Asset Holding Ltd (AIAHL) or by making budgetary provisions. Non-core assets, art and artefacts, as well as other non-operational assets of the national carrier too, will be transferred to the SPV.

According to government officials, an amount of Rs 23,286.50 crore will be bundled with the airline, which is frozen to provide certainty to bidders. Also, certain identified current and non-current liabilities other than debt will also be bundled with the disinvestment package. The combined debt and liabilities that the buyer will take on stands at Rs 32,058 crore.

The government has issued the first set of clarification on Air India's disinvestment queries answering interested bidders on the 'confidentiality undertaking' listed out in the preliminary information memorandum issued on January 27.

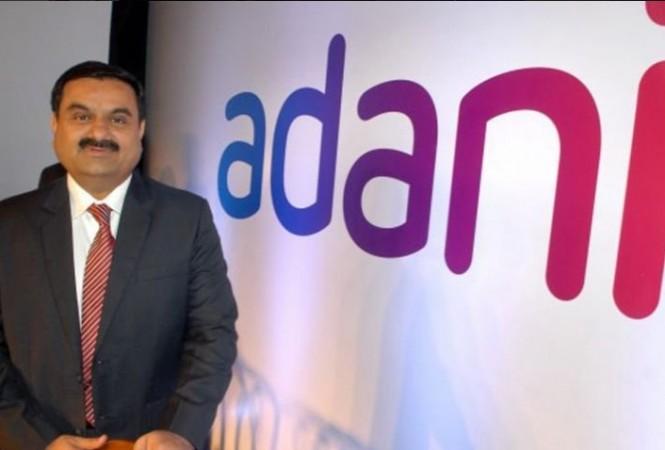

Adani eyes Air India

Billionaire Gautam Adani-led Adani Group is conducting due-diligence on Air India Ltd and it might bid to buy 100 per cent stake in the debt-ridden airline. According to sources, Adani Group's M&A team is scrutinising Air India bid documents and considering the expression of interest at a preliminary stage to perhaps join the likes of the Hinduja family, Tata Group, IndiGo airlines and New York-based fund Interups Inc.

If sources are to be believed, since Adani group had last year won bids to operate six airports at Ahmedabad, Lucknow, Jaipur, Guwahati, Thiruvananthapuram and Mangalore, the group sees synergy in Air India and its airport operations post-acquisition of Air India.

However, the Airports Authority of India (AAI) restricts an airline or a group owning an airline to hold no more than 27 per cent in the airports. This particular clause has restricted airlines or group-owning airlines from holding more than 10 per cent in Delhi airport, which recently resulted in the collapse of Tata-GIC group's investment in GMR Airports.