News aggregating platform, DailyHunt, was in talks with China's SoftBank to raise funds last year, which did not go through as planned. But that hasn't frozen the incoming investments for the Bengaluru-based startup. DailyHunt, in the latest Series G funding round led by Falcon Edge, added Rs 180 crore to its kitty.

Series G funding: DailyHunt

Here's a breakdown of the investments made during the latest funding round:

- Falcon Edge: Rs 71.85 crore

- ByteDance: Rs 35.92 crore

- Goldman Sachs Asia: Rs 35.92 crore

- Advent Management Belgium: Rs 35.92 crore

With this, DailyHunt's valuation is close to Rs 4,200 crore. As per Entrackr's estimates, DailyHunt's estimated valuation stands at Rs 4,164 crore - a steep Rs 494 crore or 13.44 percent spike from August last year.

Shares allotment

Following the funding round, shares of DailyHunt are distributed as follows:

- Falcon Edge: 55,294 shares

- ByteDance: 27,647 shares

- Goldman Sachs Asia: 27,647 shares

- Advent Management Belgium: 27,647 shares

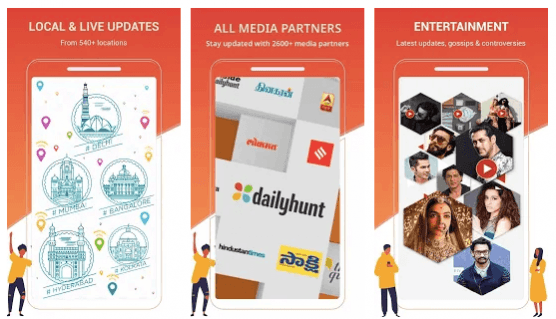

DailyHunt is a popular app for smartphone users. It collects news from other news and media platforms and delivers it to users in a single place. DailyHunt's biggest USP is its vernacular focus, offering content in 14 languages. The app has already been downloaded more than 155 million times on Google Play Store.

DailyHunt has over 1300 publication partners and over 263 million monthly active users across all platforms, of which 208 million are mobile users. DailyHunt competes against the likes of InShorts, UC News, NewsDog among others.

Startups and investments

Due to the coronavirus pandemic, which has hit the economy really hard. For Indian startups, investors and venture capitalists have cautioned that worst times are yet to come and asked them to cut down on spending. During these challenging times, DailyHunt raising funds gives a positive outlook for startups and founders, who have had to cut salaries or lay-off employees.

Besides DailyHunt, another Bengaluru-based startup NoBroker raised $30 million from a single investor General Atlantica amid economic slowdown.