Christmas may not be merry for Indians this year if crude oil price predictions come true. A speculated spike in global prices of crude oil to $60 per barrel or more would end up as a double whammy for them, after the November 8 decision to demonetise high-value currencies (Rs 500 and Rs 1,000).

Prime Minister Narendra Modi announced the decision to scrap the two denominations sending a cash-dominated economy into a tizzy, with the composite PMI for November falling to 49.1 in November. On the last day of the month, oil producing countries (OPEC) agreed to limit crude oil output, sending prices soaring.

In an interview with business news channel CNBC-TV18, Mark To of Wing Fung Financial Group predicted that in the context of changing demand-supply situation, crude oil prices could go up to $60 per barrel by Christmas.

India being a net importer of oil, has a lot to worry, given that non-OPEC countries struck a deal with their OPEC counterparts to slash oil production that will reduce the glut and thereby lift prices.

Brent Crude, considered a global benchmark for crude prices, rose to highest level since July 2015 to $57.89 per barrel on Sunday/Monday in overnight trading, reported Reuters.

The first spurt in prices was on November 30 when an agreement among OPEC to reduce production by 1.2 million barrels per day saw Brent Crude gained almost 10 percent to hit a 16-month high of over $50 per barrel.

Fuel pricing dynamics in India

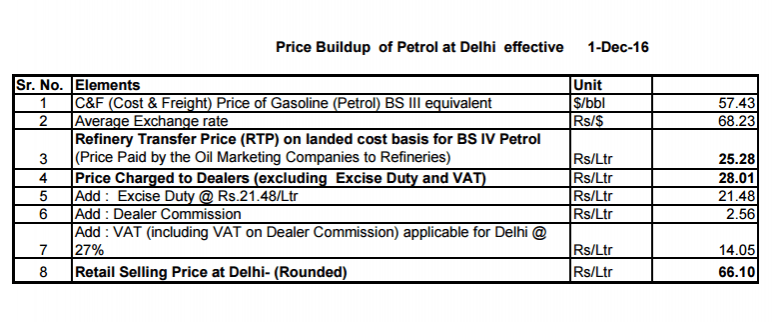

On December 1, 2016, the international crude oil price for India rose sharply to $50.27 per barrel from $45.83 per barrel the previous day. On the first of this month, the retail price of non-branded petrol was Rs 66.10 per litre in Delhi.

If the international price for India were to spurt beyond $60 per barrel, it's only a question of time that the Modi government will increase prices of petrol and diesel, even if excise duty and other levies (value added tax, or VAT) were to remain unchanged.

To put things in perspective, the crude oil price for India was $32.79 per barrel on January 1, 2016; $39.49 on August 2; $45.78 on November 1 and $51.34 on December 8, 2016.

If the increasing trend in global crude oil prices translates the government to hike petrol, diesel prices, it is bound to push inflation in the coming months. If that happens, there won't be a reason for the Reserve Bank of India (RBI) to cut interest rates.

Even if oil marketing companies such as Indian Oil Corporation (IOC), BPCL and HPCL do not raise prices in the immediate, a hike would become imminent if global crude oil prices continue to rise.