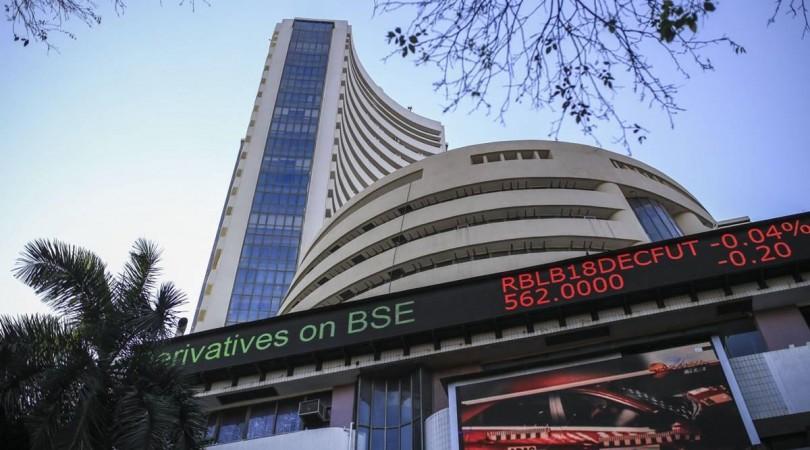

The key Indian equity indices declined on Wednesday morning with the BSE Sensex losing over 300 points. Heavy selling pressure was witnessed in banking, finance and IT stocks.

Decline in the index heavyweights Infosys and HDFC also weighed on the Sensex. Around 10.10 a.m., Sensex was trading at 51,601.51, lower by 333.37 points or 0.64 per cent from its previous close of 51,934.88.

It opened at 51,749.10 and has so far touched an intra-day high of 51,863.94 and a low of 51,590.25 points. The Nifty50 on the National Stock Exchange (NSE) was trading at 15,498.65, lower by 76.20 points or 0.49 per cent from its previous close.

Manish Hathiramani, technical analyst with Deen Dayal Investments said: "The Index has started on a soft note this morning. It has had a good rally up and perhaps there could be marginal profit booking and offloading of positions."

"However, the trend continues to remain positive and we should be heading to 15,900-16,000 as the next potential target. Since there is a good support at 15,300, every dip or intra-day correction can be utilised to accumulate long positions," he said.

The top gainers on the Sensex were Power Grid, UltraTech Cement and NTPC, while Tech Mahindra, ITC and Infosys were the major losers.

SEBI bars 8 entities

Meanwhile, the Securities and Exchange Board of India (SEBI) has barred eight entities, including individuals and two financial companies, for being involved in insider trading in the scrip of Infosys.

The entities are Pranshu Bhutra, Amit Bhutra, Bharath C. Jain, Manish C. Jain, Ankush Bhutra, Venkata Subramaniam V.V., and firms Capital One Partners and Tesora Capital. The investigation found that the total proceeds generated from insider trading was over Rs 3.06 crore.

The SEBI has directed the impounding of the bank accounts of those involved and also asked them to create an escrow account jointly and severally and deposit the impounded amount in that account within 15 days from the order.