The new surge in Covid-19 cases and lockdowns in China besides the Ukraine conflict led to tech shares rout on Tuesday, slashing billions of dollars from the likes of Alibaba Group Holding and Tencent Holdings in Hong Kong, media reports said.

According to South China Morning Post, Hang Seng Index hit a new six-year low as more than $460 billion of market value from tech stocks evaporated this year and Alibaba crashed by a record 12 per cent.

The lockdowns weighed on China's stock market trading, shrinking Shanghai's Monday turnover by 12 per cent to $60 billion, shaving 10.3 per cent off Shenzhen's volume of traded shares to $85.2 billion.

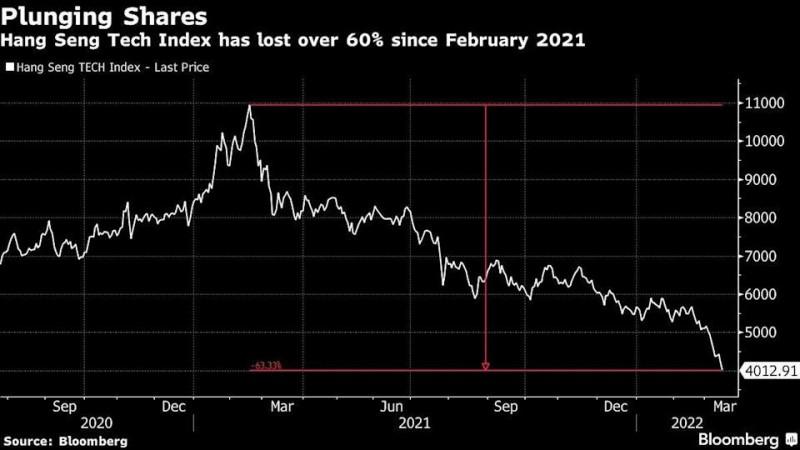

Asia Nikkei reported that the Hang Seng Tech Index initially sank 7.2 per cent when trading started in Hong Kong on Tuesday.

"Alibaba tumbled 11.9 per cent, Tencent 10.2 per cent, and Meituan 5.9 per cent. JD.com slipped 10.1 per cent while Ping An Insurance Group, parent of several separately listed tech companies, sank 12.6 per cent," the report noted.

"We believe that China's geopolitical risks, along with escalating volatility across all asset classes and weak equity performance of global growth sectors, makes risk management the most important consideration for investors with a global mandate in relation to their China Internet investment strategy," said JPMorgan.

In a note published on Tuesday, Goldman Sachs said that current valuations implied Chinese internet companies would be able to post annual profit growth of only 8 per cent over the next decade.

Last week, Chinese stocks in the US suffered their biggest selloff since 2008 after US regulators identified five companies that could be subject to delisting for failing to comply with auditing requirements.

(With inputs from IANS)

!['Had denied Housefull franchise as they wanted me to wear a bikini': Tia Bajpai on turning down bold scripts [Exclusive]](https://data1.ibtimes.co.in/en/full/806605/had-denied-housefull-franchise-they-wanted-me-wear-bikini-tia-bajpai-turning-down-bold.png?w=220&h=138)