As Chinese e-commerce giant Alibaba goes public with its plans to raise $21.8 billion by offering $68 per share to their investors, the company takes a step forward and is now in talks with online retailer Snapdeal to make a foray into Indian e-commerce market. It plans to raise up to $300 million in the first round of fund raising.

Once the deal is approved, Snapdeal's market value would notch up to $4 billion in its next round of investment.

Alibaba's shares are set to make a debut in the US market from Friday, with a market valuation of $167.6 billion (₹10 lakh crore), a figure much higher than any other corporate icons.

Until now, Alibaba has been contacting Indian merchants with foreign buyers and sellers. However, by teaming up with Snapdeal, it would compete with other major brands like Flipkart and Amazon, reported Economic Times.

Delhi-based four-year-old Snapdeal is a growing e-commerce firm which has attracted investments from Asian icons like Japan-based Rakuten and SoftBank besides Indian tycoons like Ratan Tata and Azim Premji.

Due to strong demand from investors, Alibaba raised its share value to $68 from $66 on Monday. The Chinese e-commerce giant founded in 1999 by Jack Ma, which made its debut in India as a B2B online platform in 2010, now has plans to boost its business by entering e-commerce Industry by teaming up with Snapdeal.

China could dominate Indian online market:

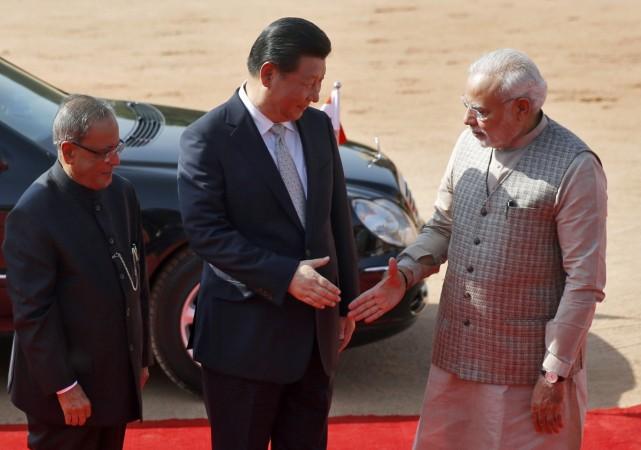

On 18 September, Xi Jinping, the Chinese President who is on his maiden trip to Delhi, announced that the Chinese government would invest over $20 billion in the next five years in various sectors in India.

China is the leading consumer goods supplier and manufacturer and e-commerce is one of the major platforms to boost sales of Chinese products, according to an opinion report by Firstpost.

For B2B sales, e-commerce has played a vital role in sales of Chinese products.

With China's heightened interest in Indian e-commerce, will Narendra Modi's vision of making India a manufacturing base suffer a Sino blow?