In a major development, the Government of India on Tuesday, May 5, hiked the excise duty on petrol by Rs 10 per liter and on diesel by 13 per liter. The move by the Centre comes amid the heavy loss in revenue pertaining to the ongoing nationwide lockdown to contain the spread of the novel coronavirus.

The change in the tax will come into effect from Wednesday, May 6. However, the increase in excise duties will not affect the retail sale price of petrol and diesel in the country.

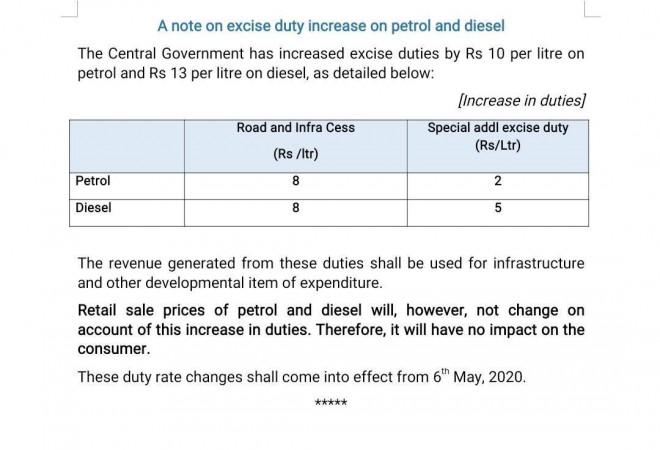

Breakdown of the increase in excise duties

As per the official notifications issued by the Central government, a road cess of Rs 8 per liter has been levied on both petrol and diesel. Additionally, special additional excise duties have been raised by Rs 2 per liter on petrol and Rs 5 per liter on diesel. With this, the net increase in excise duties comes to be Rs 10 per liter on petrol and Rs 13 per liter on diesel.

Speaking of the alteration in the tax structure of oils, a government official said that the increase in excise duties will be absorbed by OMCs and the MRP of petrol and diesel will remain the same. He further stated that the Centre will use the revenue generated from duties for improving the infrastructure of the country as well as for other development purposes.

Global oil prices at an all-time low

The novel coronavirus pandemic has resulted in the crash of crude oil prices across the globe as most of the countries have imposed a complete lockdown to break the chain of transmission. Therefore, the move by the Centre to hike excise duties can be perceived as an attempt to make up for the revenue loss by taking advantage of low oil prices.

Notably, this is the second such hike in taxes since March when the government had raised duties on petrol and diesel by Rs 3 per liter. However, the increase in central levies did not impact the retail price of fuel due to the fall in crude oil prices worldwide.