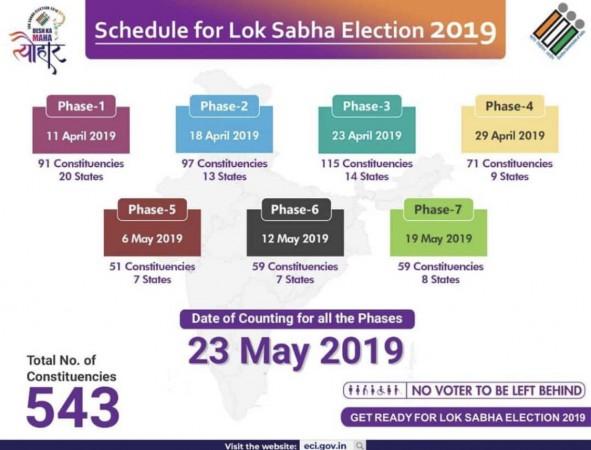

Traders are cautious as they expect the market to move sideways this week with the unveiling of the first phase of the general election 2019 in which Prime Minister Narendra Modi-led Bharatiya Janata Party (BJP) is trying to return to power. Bombay Stock Exchange (BSE) benchmark Sensex closed last week with a net weekly gain at 38,862 points, up 0.46 per cent on Friday. National Stock Exchange (NSE) Nifty 50 also closed with a weekly net gain to top 11,665 points, marking a 0.59 per cent on the last day.

The week ahead promises action as March quarter earnings season kicks off with IT majors TCS and Infosys amid election hype and release of the consumer price index (CPI), inflation and factory data. The general bullish bias supported by the market optimism of a Prime Minister Modi's return to New Delhi with a decisive mandate gives traders scope to buy on dips, experts say. Last week's volatility seems a curtain raiser to the next month and a half when the country winds its way through the tortuous election process the results of which are scheduled to be announced on May 23 to be followed by government making.

Barring the continuing uncertainty over Brexit, most global cues are conducive to a bullish bias with the US-China trade war fears receding. Nifty 50 closed a volatile week with a net gain of 42 points or 0.36 per cent over the previous week's close even with the elections and subsequent likely government-making chaos at the market's doorsteps.

Experts advise traders to stick to traditionally defensive sectors like IT and pharma unless the market makes a healthy correction in the first half of the week. Higher levels of the index could trigger bouts of profit taking as Nifty levels of 11,760 and 11,845 remain vital resistance points. Technical charts show support levels at 11,501 and 11,420, according to the experts Economic Times cites.

The weekly relative strength index (RSI) at 67.7869 is at a fresh 14-period high, but the absence of a divergence from the price is tempering traders' enthusiasm. However, the position of MACD above the signal line confirms the bullish bias and hence the advice to watch for dips to initiate fresh buys. But the Doji Star on the candle capping the upward move reveals bearish potential suggesting extra caution with tight stop loss setting. In the circumstances, experts suggest a highly stock-specific risk-averse approach to individual traders.

"We expect Nifty to consolidate after the sharp surge while volatility will remain high on a stock specific front as participants would react to the earnings announcement of IT majors viz. Infosys and TCS," Jayant Manglik of Religare Broking told Moneycontrol. He also advised trades to watch for scheduled release for macroeconomic data like the Index of Industrial Production (IIP) and CPI apart from the choppiness from the warming up general election scene.

On the heels of TCS and Infosys results on April 12, a host of other major players will be announcing their March quarter results and some even full year earnings data. Delta Corp, Tata Metaliks, Bajaj Consumer Care, Tinplate Company, and GTPL Hathway will also announce their earnings for the quarter this week. Brokerages expect double-digit earnings growth in Q4 of FY19 driven by banks and single-digit growth in revenue.