Non-banking finance companies (NBFCs) – which are often considered as the shadow banking sector – are on their way to setting a record of a robust growth of 19–22 percent CAGR in retail credit to reach an AUM (assets under management) of approximately Rs 6.04 lakh crore by March 2017, up from Rs 5.01 lakh crore by March 2016.

RBI forced banks to grant loan to Kingfisher Airlines violating its own rules

Apart from better knowledge of the market they are operating in, the success of NBFCs in India can be attributed to their product lines, lower costs and strong risk management capabilities to check and control bad debts.

Not only in traditional passenger and commercial vehicle finance, NBFCs have also successfully managed to build substantial AUM in the personal loan and housing finance segments, which so far have been the bread and butter for retail banks.

In a few states where traditional banking has very less penetration in rural areas, NBFCs have been playing a very important role from the macroeconomic perspective and are emerging as better alternatives to the conventional banks for meeting the financial needs of micro, small and medium enterprises (MSMEs).

Moreover, with the ongoing stress in the public sector banks due to mounting bad debt, it is expected that their appetite to lend (especially in rural areas) is only going to deteriorate. And it remains to be seen if NBFCs can tap that opportunity to increase their presence.

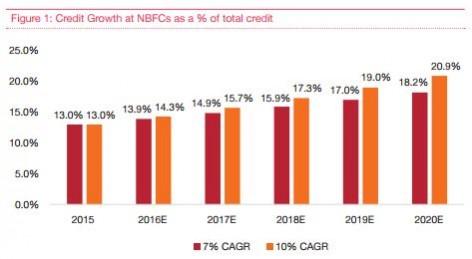

Additionally, the latent credit demand of an emerging India will allow NBFCs to fill the gap. Improving macroeconomic conditions, higher credit penetration, increased consumption and disruptive digital trends will allow NBFCs' credit to grow at a healthy rate of 7–10 percent (real growth rate) over the next five years, according to a study by PwC and Assocham.

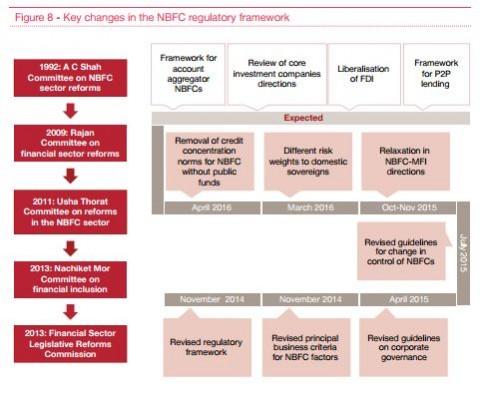

However, to survive and grow constantly, NBFCs need to be very dynamic and constantly endeavour to search for new products and services in order to operate in this ever-competitive financial market. At the same time, NBFCs seem to be working under certain regulatory constraints that put them at a disadvantage vis-à-vis banks.

The Reserve Bank of India, despite its spate of reforms in the NBFC regulations, must ensure that NBFCs have a level-playing field against banks to fully realise their potential.

Types of NBFCs in India: Asset Finance Company (AFC), Investment Company (IC), Loan Company (LC), Infrastructure Finance Company (IFC), Infrastructure Debt Fund: Non-Banking Financial Company (IDF-NBFC), Gold Loan NBFCs and Residuary Non-Banking Companies (RNBCs).

Meanwhile, the RBI said on Monday that 10 NBFCs, including Supreme Securities and Island Leasing, have surrendered their registration certificate. The central bank also said it cancelled the certificate of registration of nine other NBFCs.