The BSE benchmark Sensex rallied over 500 points in afternoon trade Friday, driven by consumption and auto stocks as investors welcomed individual tax exemptions and sops in the farm sector announced in the interim Budget.

Overall, market sentiment was bullish even as the government overshot the fiscal deficit target for the current financial year and announced some populist measures, which experts believe will increase fiscal burden on the exchequer.

The 30-share Sensex was trading 506.21 points or 1.40 per cent, higher at 36,762.90; and the 50-share Nifty inched near the 11,000 mark rallying 143.30 points, or 1.32 per cent, to 10,974.25.

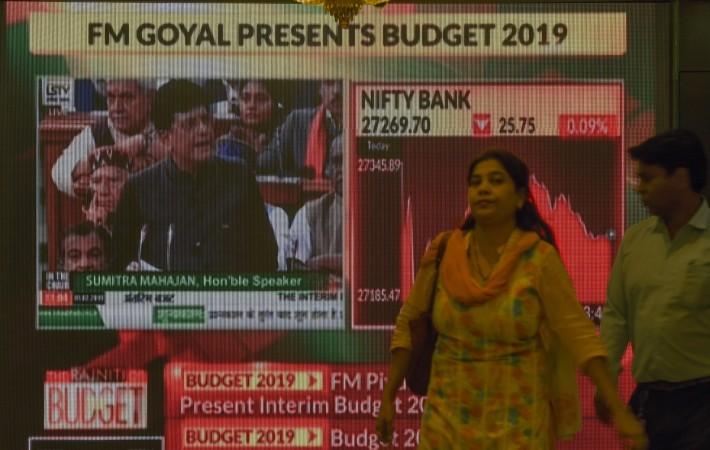

In a major relief to the middle-class, Finance Minister Piyush Goyal Friday proposed to double the threshold tax exemption limit to Rs 5 lakh and increased the standard deduction to Rs 50,000 from Rs 40,000.

The proposal will benefit 3 crore middle-class tax payers, Goyal said while unveiling the Budget proposals for 2019-20.

As widely expected, the finance minister announced the Pradhan Mantri Kisan Samman Nidhi for small and marginal farmers, providing Rs 6,000 per year to be transferred directly to farmers' bank accounts.

Goyal said the fiscal deficit for the current financial year is expected to be 3.4 per cent of GDP. As per the Budget estimate, the fiscal deficit for 2018-19 was pegged at 3.3 per cent.

Consumption-driven stocks rallied the most after the Budget announcement, with BSE auto, consumer durables, FMCG and realty indices soaring up to 4 per cent.

Top gainers in the Sensex pack included Hero MotoCorp, Maruti, M&M, Bajaj Auto, HUL, HCL Tech, Bajaj Finance, ITC, HDFC and L&T, rising up to 7.51 per cent.

Vedanta was the biggest loser on Sensex, cracking over 16 per cent after the metals and mining giant Thursday reported a 25.54 per cent decline in consolidated net profit at Rs 1,574 crore for the December 2018 quarter on the back of higher expenses and drop in commodity prices.

Other losers included Axis Bank, Yes Bank, ICICI Bank and PowerGrid, falling up to 0.72 per cent. The rupee, meanwhile, was trading 5 paise lower against US dollar to 71.13.